Renowned globally for its manufacturing prowess and entrepreneurial spirit, Gujarat now confronts a complex paradox as it seeks to translate its industrial dominance into a thriving aerospace and defense ecosystem. As the state government prepares to unveil its new Aerospace and Defence (A&D) Policy at the Vibrant Gujarat Regional Conference in Rajkot, the critical question is not whether it can attract another large-scale investment, but whether it can cultivate the intricate network of smaller enterprises essential for sustainable, long-term growth. This new framework, replacing the foundational policy that concluded in 2025, represents a pivotal moment to pivot from a strategy of attraction to one of deep-rooted cultivation, determining if the state can truly become a self-reliant A&D hub.

Beyond the Big Ticket: Why Gujarat’s Small Industries Are the Real Test for Its Defence Ambitions

The central paradox facing Gujarat’s A&D ambitions lies in the disconnect between its immense industrial capacity and the specialized needs of the defense sector. While the state is a powerhouse in engineering, casting, and manufacturing, its vast network of Micro, Small, and Medium Enterprises (MSMEs) has yet to be fully integrated into the high-technology, high-stakes A&D supply chain. These smaller firms form the backbone of the state’s economy, yet they remain on the periphery of a sector dominated by a few large players and their rigid, often international, supply networks.

As officials finalize the new policy, the debate shifts from securing headline-grabbing multi-billion-dollar projects to a more nuanced challenge: building a resilient ecosystem from the ground up. The true measure of the forthcoming policy will be its ability to empower these thousands of capable MSMEs, transforming them from potential suppliers into active, integral partners. The question is whether the state can architect a framework that fosters a self-sustaining network of local suppliers, moving beyond the simple goal of attracting a few large manufacturing titans.

Setting the Stage: From a Foundational Policy to a Strategic Leap

The previous A&D policy, which spanned from 2016 to 2025, served as an essential first step. Its primary objective was to put Gujarat on the national defense manufacturing map, creating a foundational base where none existed before. It successfully attracted significant initial investments, establishing a beachhead for the industry within the state. With its expiration, the necessity for a successor policy is not just a matter of continuity but an opportunity for a strategic evolution based on a decade of experience.

This policy revision is unfolding against the backdrop of a strong national imperative. The “Make in India” initiative continues to drive the country’s push toward self-reliance, or atmanirbharta, in the critical defense sector. Gujarat’s ambitions are thus directly aligned with a broader strategic goal to reduce import dependency and develop indigenous capabilities. The decision to unveil the new policy at a major platform like the Vibrant Gujarat conference underscores this alignment, signaling a renewed and high-profile commitment to positioning the state as a leader in India’s defense industrial complex.

The Core Challenge: Deconstructing the Needs of a Modern A&D Ecosystem

The 2016 policy was largely successful in its initial mission. By offering incentives and infrastructure support, it attracted anchor companies and laid the essential groundwork for an A&D presence in Gujarat. This created visibility and proved that the state could accommodate large, complex manufacturing operations. However, this foundational success has now revealed a more sophisticated set of challenges that must be addressed for the sector to mature.

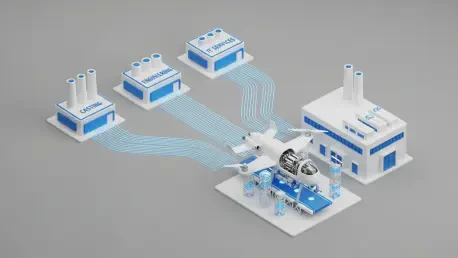

Industry consensus points to a significant “supplier gap.” Future growth, experts argue, will not be driven by adding one or two more large assembly plants. Instead, it hinges on the development of a deep, capable, and competitive network of second and third-tier suppliers who can provide the high-precision components, sub-assemblies, and specialized services that form the bedrock of any modern A&D industry. Without this robust local supply chain, primary manufacturers remain heavily dependent on external, often foreign, vendors, which limits local value addition and technology absorption.

This leads to the MSME paradox: Gujarat’s most significant industrial strength—its vast and diverse base of engineering and casting MSMEs—is simultaneously its greatest untapped resource in the A&D sector. These firms possess the technical skills and manufacturing acumen required, but they face significant barriers to entry, including stringent certification requirements, high capital costs, and restrictive procurement practices. The new policy’s primary challenge is to build a bridge across this gap, transforming this latent potential into a dynamic and integrated component of the A&D ecosystem.

Voices from the Industry: An Insider’s Look at Policy Shortfalls and Opportunities

Feedback from those on the front lines provides a clear picture of what worked and what needs to change. An office-bearer of a prominent industry association confirmed the initial success, noting that the 2016 policy was effective in attracting “some big investments” and helping to “establish a base for the future growth of the industry in the state.” This acknowledgment sets the stage not for criticism, but for a constructive evolution of the state’s strategy.

However, a director of a leading manufacturing company identified a critical barrier that has stifled local growth. When domestic firms collaborate with foreign Original Equipment Manufacturers (OEMs), they are often bound by contractual clauses that mandate the use of the OEM’s pre-approved global suppliers. This practice “does not allow the local industry to develop,” effectively locking out highly capable local MSMEs from participating in high-value contracts. This bypasses the local ecosystem, preventing technology transfer and skill development where it is needed most.

Furthermore, the very concept of physical infrastructure has come under scrutiny. A manufacturer with deep industry experience critiqued the impracticality of a single, consolidated “defence park.” The A&D supply chain is incredibly diverse, encompassing everything from a “textile unit, a chemical unit, an IT setup, and a casting foundry.” Forcing such disparate industries into one geographic location is illogical and inefficient. This highlights a need for a more flexible and intelligent approach to industrial planning.

A Blueprint for the New Policy: Three Strategic Pillars for Success

Based on industry feedback, a blueprint for a more effective policy emerges, resting on three strategic pillars. The first involves a fundamental shift in financial support, moving away from general subsidies toward targeted incentives. The focus of these incentives should be squarely on the “development of additional supplier units.” This means creating clear, accessible pathways for Gujarat’s existing engineering and casting MSMEs to achieve the necessary certifications and technology upgrades to integrate into the A&D supply chain.

The second pillar requires a direct policy intervention to mandate local value addition. This could involve creating mechanisms to counteract the restrictive supplier clauses in OEM agreements, thereby opening doors for local vendors. Encouraging joint ventures and technology transfers that include binding commitments to develop and source from local suppliers would be a crucial component. This would ensure that major investments translate into widespread industrial growth rather than remaining isolated enclaves of production.

Finally, the state should abandon the rigid “defence park” concept in favor of a more dynamic “industrial corridor” model. Instead of a single physical park, this approach proposes a virtual framework that connects existing, specialized industrial clusters that are geographically dispersed. This model, organized “by the geography of clusters,” would leverage the established infrastructure, skilled labor, and domain expertise already present across the state. Such a flexible network would integrate diverse suppliers—from textiles to IT to chemicals—into the A&D ecosystem efficiently and pragmatically.

The strategic direction for Gujarat’s aerospace and defense sector stood at a clear inflection point. The insights gathered from the industry over the past decade revealed that the initial phase of attracting large-scale investment, while successful, was only the first chapter. The narrative that unfolded was one of necessary evolution, from a policy of attraction to a more sophisticated strategy of deep ecosystem cultivation.

An analysis of the challenges and opportunities presented a compelling case for change. It became evident that the true potential of the state resided not in a few large factories but in its vast network of agile and capable smaller enterprises. The next phase of policy had to be designed to dismantle the structural barriers that kept these MSMEs on the sidelines and to create an environment where local innovation and manufacturing could flourish. The ultimate success of the new framework was measured not by the next major contract announced, but by the tangible growth and integration of this homegrown supply chain, which was the real engine for building a self-reliant defense industrial base.