In a bold and decisive maneuver that could send ripples through India’s rapidly evolving electric vehicle landscape, component manufacturer Sterling E-Mobility is fundamentally re-engineering its business model from the ground up. The company is strategically moving away from its traditional role as a supplier of standalone parts to become a comprehensive provider of integrated powertrain and power electronics systems. This ambitious transition is anchored by a clear and aggressive target: for these advanced, multifaceted systems to constitute over 70% of its total business portfolio by the fiscal year 2028. This pivot represents one of the first major domestic initiatives to build a future based on complex, integrated EV architecture, potentially setting a new benchmark for the national supply chain and challenging the existing component-based ecosystem as the industry matures into its next critical phase of growth and technological sophistication.

A Vision for an Integrated Future

The foundational logic driving Sterling’s strategic redirection is a prescient analysis of the Indian EV market’s trajectory toward greater complexity and integration. Company leadership anticipates a future where the current patchwork of disparate components gives way to highly consolidated vehicle architectures featuring fewer, more powerful multi-function units. This evolution is happening in tandem with the escalating importance of deep software integration, where hardware and software must be seamlessly intertwined to unlock advanced vehicle features and performance. Furthermore, this pivot aligns with a broader national imperative for India to cultivate its own domestic competence in critical EV technologies, thereby reducing its reliance on foreign suppliers for core systems like motors, controllers, and power electronics. Sterling’s move is a calculated effort to position itself at the forefront of these trends, transitioning from a supplier of commoditized parts to a high-value partner in developing sophisticated vehicle platforms.

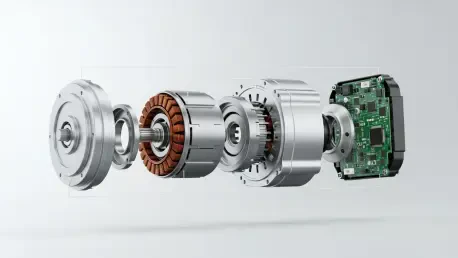

At the very core of this transformative strategy is a profound technological focus on integrated power electronics and complete powertrain systems. Sterling is channeling significant investment into the development of what the industry terms “2in1,” “3in1,” and even more complex integrated units that cleverly combine essential functions such as motors, motor control units (MCUs), onboard chargers, and DC/DC converters into a single, cohesive package. For original equipment manufacturers (OEMs), this innovative approach delivers a cascade of substantial benefits. It dramatically reduces the complexity of vehicle wiring harnesses, streamlines the overall assembly process, and significantly improves reliability by minimizing the number of connection points that could become potential sources of failure. Moreover, by consolidating multiple functions into a smaller physical footprint, these integrated systems optimize vehicle packaging, freeing up valuable space that can be reallocated for other components or to enhance passenger comfort, a critical advantage in modern vehicle design.

Building a Resilient and Advanced Foundation

While the adoption of integrated systems promises to simplify vehicle architecture for OEMs, it simultaneously introduces a new level of intricate complexity within Sterling’s own manufacturing and quality control environments. The company acutely recognizes that this advanced path necessitates massive, strategic investments in heavy automation and the implementation of exceptionally robust quality assurance protocols. The stakes are extraordinarily high; the failure of even a single, minor “child component” nested deep inside an integrated system has the potential to immobilize an entire vehicle. This reality makes absolute reliability a non-negotiable cornerstone of its production philosophy, compelling the company to build a resilient and technologically advanced foundation capable of meeting the rigorous demands of next-generation electric mobility and ensuring that every unit performs flawlessly in the field.

A key pillar of Sterling’s forward-thinking technology strategy is its proactive approach to mitigating the geopolitical and supply chain risks associated with rare-earth minerals. By licensing and localizing a sophisticated High-Density Reluctance Motor (HDRM) technology, the company is strategically engineering out its dependence on the rare-earth magnets that are critical to many conventional EV motors but are subject to volatile supply chains. This innovative magnet-free motor design provides a crucial strategic hedge not just for Sterling but for the entire Indian EV industry, offering a powerful and efficient motor solution that is specifically tailored for demanding local operating conditions. By focusing on key performance metrics such as efficiency, cost, and thermal performance, this technology builds resilience against international supply disruptions and addresses the significant environmental concerns linked to the mining of rare-earth elements.

To substantiate its ambitious strategic vision, Sterling is committing significant financial resources to upgrade its operational capabilities, with a planned investment of approximately ₹18 crore in the current year, which follows a substantial ₹28 crore investment made in the preceding year. This capital is being meticulously allocated to enhance both production capacity and quality assurance. Key areas of focus include acquiring state-of-the-art production equipment for core products alongside advanced product validation systems, automated soldering processes, and comprehensive end-of-line testing rigs. This is complemented by an intelligent manufacturing strategy that leverages India’s mature Surface-Mount Technology (SMT) ecosystem for outsourcing, allowing Sterling to concentrate its own capital on developing its core competencies in automated and scalable assembly lines, supported by advanced thermal-performance engineering to ensure product durability and long-term reliability.

Redefining Partnerships and Corporate Structure

The fundamental shift from a component supplier to a systems provider has profoundly altered Sterling’s role and responsibilities within the intricate automotive value chain. Its new multifunction EV units must now interface flawlessly with a multitude of other complex vehicle systems, including high-voltage battery packs, central vehicle control software, and digital instrument clusters. This new reality demands a far deeper and more integrated level of collaboration with OEMs, transforming the relationship from a simple transactional exchange into a dynamic, co-development partnership. Sterling is now engaged with its clients much earlier in the vehicle design process, ensuring that its systems are not merely added but are holistically integrated into the vehicle’s core architecture, a move that is essential for achieving optimal performance, efficiency, and reliability in the final product.

This deeper integration with customers is mirrored by an expanded footprint of responsibility that now extends well into after-sales support and field service. Recognizing that it is now accountable for the behavior of an entire system, Sterling has begun working closely with OEM service teams to provide comprehensive training and co-develop new diagnostic processes to effectively address any issues that may arise once a vehicle is in the hands of a consumer. This commitment signifies a paradigm shift in ownership, where the company actively assists its customers in problem-solving across the system, irrespective of whether the root cause of an issue lies strictly within its product boundary. This proactive stance on service and support is designed to build long-term trust and underscores the company’s evolution into a true solutions partner for its OEM clients.

To ensure its internal structure was fully aligned with its forward-looking market strategy, Sterling underwent a significant corporate reorganization. The company was restructured into three distinct verticals, each sharply focused on a key pillar of future mobility: Fasteners, Powertrain and Power Electronics, and Electrical Components and Active Safety Products. This deliberate realignment solidified the company’s commitment to its new direction and created a more agile and specialized operational framework. With this new structure in place, the company had set a clear timeline for its transformation, anticipating that the tangible financial and operational results from its strategic pivot would become visible starting in FY27, as new customer programs featuring its integrated systems entered mass production and began reaching the market.