In a striking turn of events that underscores the volatile nature of the electric vehicle (EV) industry, Foxconn, the global manufacturing giant, has offloaded its Lordstown, Ohio factory—a site once heralded as a cornerstone for American EV production. This facility, previously owned by General Motors and later acquired by Foxconn from the embattled startup Lordstown Motors, was meant to be a hub of innovation and manufacturing in the burgeoning EV market. Yet, after years of unmet promises, failed partnerships, and minimal output, the sale to a little-known entity signals a significant retreat from those ambitious goals. The transaction not only raises questions about Foxconn’s future in the U.S. automotive sector but also highlights broader challenges faced by foreign companies navigating the complexities of this rapidly evolving industry. As the dust settles on this deal, the story of the Lordstown factory serves as a cautionary tale of high hopes clashing with harsh realities.

A Troubled Journey in American EV Manufacturing

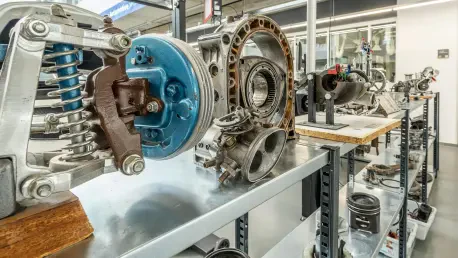

Foxconn’s venture into the U.S. EV market began with bold aspirations when it acquired the Lordstown factory for $230 million several years ago. The plan was to transform the sprawling facility into a major hub for EV production and research in North America, leveraging Foxconn’s expertise as a leading contract manufacturer. However, the reality fell far short of expectations. Production numbers remained dismal, with only a handful of vehicles rolled out for Lordstown Motors before the startup spiraled into bankruptcy. Disputes soon erupted, with accusations of financial mismanagement and sabotage clouding the partnership. This setback was not an isolated incident but rather the beginning of a pattern of struggles for Foxconn at the site. The company’s inability to establish a steady production rhythm or secure lasting collaborations underscored deeper issues in adapting its manufacturing prowess to the unique demands of the American EV landscape.

Compounding these challenges were Foxconn’s faltering relationships with other EV startups. Agreements with companies like IndiEV and Fisker Inc. collapsed as both entities faced financial ruin, filing for bankruptcy in recent years. Another partnership with Monarch Tractor yielded negligible results, with production limited to just a few hundred electric tractors. These repeated failures painted a grim picture of Foxconn’s foray into the U.S. market, revealing a disconnect between its ambitious rhetoric and the practical execution required to succeed in a highly competitive and volatile industry. The Lordstown factory, once a symbol of promise, became emblematic of Foxconn’s broader struggles to gain a foothold in EV manufacturing. This string of disappointments ultimately set the stage for a strategic pivot, as the company sought to distance itself from the mounting losses and refocus its efforts elsewhere in the tech sector.

Details of the Sale and Shifting Priorities

The recent sale of the Lordstown factory to Crescent Dune LLC, a newly formed Delaware-based entity described as an existing business partner, marks a pivotal moment for Foxconn. The deal, valued at approximately $88 million for the facility itself and an additional $287 million for machinery and equipment, represents a significant financial transaction but also a symbolic withdrawal from the original vision for the site. While Foxconn has publicly stated its intent to remain involved in manufacturing at the location and maintain commitments to its automotive customers, emerging reports suggest a shift in focus. Instead of EVs, the company appears to be pivoting toward producing AI servers at the facility—a move that aligns with its core competencies in electronics and computing technology. This redirection raises questions about the long-term role of the Lordstown site in the automotive industry and whether Foxconn will fully exit EV production in the U.S.

Beyond the specifics of the sale, the identity of the buyer adds an element of intrigue to the transaction. Crescent Dune LLC remains shrouded in mystery, with limited public information available about its operations or intentions for the factory. This lack of transparency fuels speculation about the future direction of the site and whether it will continue to play any role in vehicle manufacturing. Meanwhile, Foxconn’s track record of unfulfilled promises in the U.S., including a highly publicized but ultimately underwhelming LCD factory project in Wisconsin, casts a shadow over its assurances of ongoing involvement. The sale of the Lordstown facility, while a pragmatic step to cut losses, reflects a broader trend of recalibrating expectations and retreating from the high-stakes gamble of EV production. As the industry continues to evolve, this transaction serves as a reminder of the formidable barriers to entry for even the most established global players.

Lessons Learned and Future Implications

Reflecting on the saga of the Lordstown factory, it becomes evident that Foxconn’s ambitious push into U.S. EV manufacturing encountered insurmountable hurdles. The collapsed partnerships with multiple startups, coupled with legal and financial disputes, painted a picture of strategic missteps and overoptimism. Each failed collaboration, from Lordstown Motors to Fisker Inc., highlighted the inherent risks of aligning with financially unstable entities in a nascent industry. Moreover, the minimal production output at the facility stood in stark contrast to the grandiose plans initially laid out, revealing a gap between vision and execution. This chapter in Foxconn’s history serves as a sobering example of the challenges foreign companies face when attempting to break into the American automotive market, particularly in a sector as dynamic and unpredictable as electric vehicles.

Looking ahead, the sale of the Lordstown factory prompts critical considerations for the broader tech and automotive industries. Stakeholders must closely monitor how Foxconn reallocates its resources, particularly with the rumored shift to AI server production, to understand its long-term strategy in the U.S. For other global manufacturers eyeing the EV space, this case underscores the importance of robust partnerships, realistic goal-setting, and adaptability to market fluctuations. The mysterious new owner of the facility also warrants attention, as their plans could either revitalize the site or further diminish its relevance in manufacturing. Ultimately, navigating the future requires a balanced approach—learning from past missteps while remaining open to innovative opportunities in a rapidly changing technological landscape.