In the heart of Detroit, where the roar of engines once defined an era, General Motors (GM) has ignited a spark of optimism amid a storm of industry challenges, with tariffs looming like dark clouds and the electric vehicle (EV) market facing unexpected detours. GM has not only held its ground but also raised its full-year earnings forecast, posting a staggering third-quarter performance that left Wall Street stunned. Adjusted earnings hit $2.80 per share against a predicted $2.28, signaling a resilience that begs the question: How is this automotive giant steering through such turbulent terrain? This story dives into the strategies, numbers, and voices shaping GM’s remarkable journey.

Why This Moment Matters for GM

Beyond the headlines of financial triumphs, GM’s latest forecast adjustment—from $9.75 to $10.50 per share—carries weight for an industry grappling with uncertainty. The auto sector faces a maze of economic shifts, policy changes, and consumer hesitations, yet GM’s ability to exceed expectations reflects a broader narrative of adaptation. This isn’t just about numbers; it’s about what this resilience means for American manufacturing, job security, and the push for domestic production in a globalized economy.

The significance extends to everyday consumers and policymakers alike. As supply chain disruptions and tariff pressures test the limits of profitability, GM’s performance offers a glimpse into how strategic pivots can safeguard a cornerstone of the national economy. This moment underscores the delicate balance between innovation and stability, setting the stage for a deeper look at how GM is navigating these dual challenges.

Unpacking the Financial Powerhouse

GM’s third-quarter results paint a picture of unexpected strength, with revenue soaring to $48.59 billion, far surpassing the anticipated $44.27 billion. Even as net income dipped year-over-year from $3.06 billion to $1.33 billion, the adjusted earnings figure of $2.80 per share highlights operational grit. This financial surge triggered a pre-market stock jump of over 9%, a clear nod from investors who see GM as a leader in turbulent times.

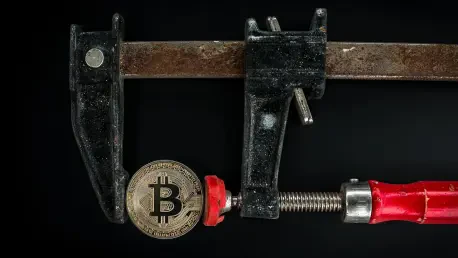

Tariff impacts, initially forecasted at a daunting $4 to $5 billion, have been revised down to $3.5 to $4.5 billion, with mitigation strategies offsetting 35% of the burden. Recent policy shifts, including tariff rebates on auto parts extended until 2030, have provided a lifeline. These measures, aimed at bolstering domestic manufacturing, align with GM’s focus on reducing exposure to import costs while maintaining competitive pricing.

Meanwhile, the EV landscape presents a thornier challenge. A $1.6 billion hit in the third quarter, driven by slower adoption after the elimination of federal tax credits and relaxed emissions rules, has forced a recalibration. Yet, GM remains committed to cutting EV losses by 2026, balancing short-term setbacks with a long-term vision for sustainable mobility.

Leadership Insights and Industry Echoes

At the helm, GM CEO Mary Barra has voiced confidence in the company’s direction, emphasizing the edge gained from the MSRP offset program for U.S.-produced vehicles. “This initiative strengthens our position in a competitive market,” Barra noted, highlighting how a domestic focus not only mitigates tariff impacts but also boosts consumer trust. Her optimism about EV performance, despite market headwinds, signals a belief in eventual growth for this critical segment.

Analysts echo this sentiment, with FactSet’s earlier prediction of $9.46 per share now overshadowed by GM’s revised outlook. This gap between expectation and reality underscores the company’s knack for surpassing benchmarks. Industry-wide, other automakers are similarly rethinking EV timelines amid policy flux and consumer reluctance, pointing to a shared struggle to align innovation with practicality in an unpredictable regulatory environment.

The broader context reveals a sector at a crossroads. As tariffs reshape cost structures and EV adoption lags, GM’s proactive stance—rooted in both financial discipline and strategic investment—offers a blueprint for others. This adaptability is not just a corporate win but a signal of how policy and market forces are reshaping the automotive future.

Investing in American Roots

GM’s commitment to domestic production emerges as a cornerstone of its strategy, with a $4 billion investment planned over the next two years in plants across Tennessee, Kansas, and Michigan. The goal? To produce over 2 million vehicles annually on U.S. soil, reinforcing a legacy of American-made innovation. Additionally, nearly $1 billion will fuel advanced V8 engine production in New York, blending traditional power with modern efficiency.

This focus on homegrown manufacturing isn’t merely about numbers—it’s a response to national priorities around job creation and economic strength. By leveraging incentives and policy rebates, GM aims to cushion tariff blows while ensuring that communities tied to its factories see tangible benefits. Such moves position the company as a pillar of stability in regions hungry for industrial revival.

Charting the Path Forward

Looking ahead, GM’s roadmap blends pragmatism with ambition, prioritizing profitability without abandoning innovation. Efforts to trim EV overcapacity ensure resources align with demand while maintaining a strong presence across iconic brands like Cadillac, Chevrolet, and GMC. This balance reflects a nuanced understanding of market realities, where sustainability goals must coexist with economic viability.

Tariff mitigation remains a key focus, with domestic production incentives and policy alignments helping to offset costs. These frameworks provide a buffer against global uncertainties, allowing GM to maintain competitive pricing without sacrificing quality. It’s a strategy that other industries might well study as trade policies continue to evolve.

Reflecting on this journey, GM’s story over recent months stands as a testament to resilience in the face of daunting odds. The blend of financial acumen, strategic investments, and adaptability has carved a path through tariff storms and EV uncertainties. As the road stretches into uncharted territory, the next steps involve doubling down on domestic strength, refining EV strategies for a shifting market, and advocating for policies that support both innovation and economic health. This saga reminds all stakeholders that in an industry defined by change, the ability to pivot with purpose is the true engine of progress.