In an era marked by rapid technological advancements and stringent regulatory requirements, the medical device industry faces immense pressure to innovate while maintaining cost-efficiency. The global medical device outsourcing market is emerging as a formidable solution to this challenge. By leveraging specialized services, companies can navigate complex landscapes and focus on core competencies. This burgeoning market is projected to reach USD 232.8 billion by 2028, growing at a CAGR of 11.2%. This article examines how medical device outsourcing can drive cost-effective innovation in the industry.

Growing Market Size and Demand

Increasing Market Opportunities

The medical device outsourcing market is witnessing significant growth, driven by the need for innovative and cost-effective healthcare solutions. With projections reaching USD 232.8 billion by 2028, this market offers enormous opportunities for companies to outsource their product design, development, and manufacturing processes. Companies are increasingly looking toward external partners to leverage specialized expertise that can handle the multifaceted challenges of producing advanced medical devices. By tapping into these resources, manufacturers can focus on their core technological and clinical strengths, leaving logistical and regulatory complexities to outside experts.

The rise in demand for specialized services, including regulatory compliance and quality assurance, further propels market expansion. As regulatory landscapes become more complicated, outsourcing firms that offer tailored solutions for navigating these requirements are in high demand. These firms provide critical support in areas such as documentation, regulatory submissions, and compliance monitoring, enabling device manufacturers to bring products to market more swiftly and efficiently. This growth in demand underscores the value not only of cost savings but also of strategic partnerships that specialize in meeting stringent regulatory standards and ensuring product quality.

Importance of Specialized Outsourcing Services

As medical devices become more complex and the regulatory scrutiny they face intensifies, specialized outsourcing services are gaining significant traction. Companies are increasingly relying on third-party providers for expertise in regulatory compliance, cybersecurity, and data privacy. These specialized services ensure that medical devices meet stringent standards without forcing companies to invest heavily in in-house capabilities. For example, outsourcing firms often have specialists who are adept at navigating the latest regulatory changes, enabling manufacturers to stay compliant with minimal risk.

Outsourcing also plays a critical role in ensuring the cybersecurity and data privacy of connected medical devices. The proliferation of digital health solutions has made cybersecurity a top priority, with regulatory bodies emphasizing the need for robust safeguards. Outsourcing firms offering expertise in cybersecurity can provide essential services such as data encryption, vulnerability assessments, and compliance with data protection laws. By offshoring these responsibilities, companies can maintain focus on innovation while ensuring that their products are as secure as they are effective.

Technological Advancements in Outsourcing

Impact of Additive Manufacturing and Automation

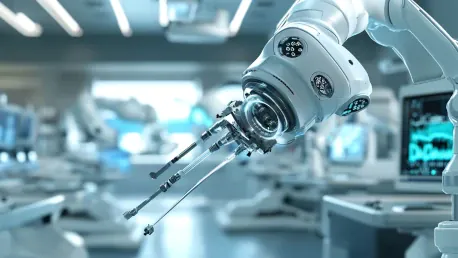

Technological advancements such as additive manufacturing (3D printing) and automation are revolutionizing the medical device outsourcing landscape. These technologies streamline production processes, reduce costs, and enhance manufacturing precision. Additive manufacturing allows for complex and customized medical devices to be produced rapidly and cost-effectively, enabling quicker iterations and innovations. Automation, on the other hand, drives efficiency and consistency in manufacturing, ensuring high-quality output with lower labor costs.

Outsourcing partners who adopt these innovations can deliver high-quality products while minimizing lead times and costs. For instance, 3D printing technology can generate prototypes and final products more rapidly than traditional manufacturing methods. This capability is particularly valuable for producing intricate parts and devices that require high precision. Automation technologies further complement this by enabling mass production of these items with consistent quality. Collectively, these advancements enable outsourcing firms to meet the rising demand for both innovation and efficiency, offering a compelling value proposition to medical device manufacturers.

The Role of Personalized Medicine and Wearables

The increasing focus on personalized medicine and wearable devices creates new opportunities for medical device outsourcing. These trends require highly specialized manufacturing techniques and rapid iteration cycles, which outsourcing providers are well-equipped to handle. Personalized medicine necessitates the creation of devices tailored to individual patient needs, which can be complex and time-consuming to produce in-house. Outsourcing to firms experienced in custom manufacturing allows device companies to meet these demands more efficiently.

Wearable devices, which monitor and manage health metrics in real time, similarly require specialized production skills. These devices must be reliable, secure, and able to integrate smoothly with other health management systems. Outsourcing firms equipped with the necessary technological capabilities can produce these devices while ensuring adherence to regulatory standards. This allows companies to quickly bring cutting-edge products to market, thereby driving both innovation and cost-efficiency in the high-demand fields of personalized medicine and wearable health technology.

Regional Insights and Market Segmentation

North America: A Dominant Force

North America leads the global medical device outsourcing market, bolstered by a well-established healthcare infrastructure and skilled workforce. Major players such as Flex Ltd. and Integer Holdings Corporation dominate the region, leveraging advanced technologies and strategic partnerships to maintain their competitive edge. The robust regulatory framework in North America also facilitates seamless collaboration between medical device companies and contract manufacturers. These companies benefit from access to cutting-edge technology and regulatory expertise, enabling them to meet both American and international standards.

The region’s dominance is also supported by a favorable business environment that encourages innovation and investment. Strategic alliances between medical device companies and outsourcers are commonplace, allowing both parties to leverage their respective strengths. Government regulations, though stringent, are well-defined and enforced, providing a stable operational landscape. This confluence of factors makes North America an attractive market for both established companies and emerging players looking to tap into global opportunities via superior outsourcing services.

Europe: Innovation and Precision Engineering

In Europe, countries like Germany, Switzerland, and the United Kingdom play pivotal roles in the medical device outsourcing market. Companies such as Tecomet, Inc. and Viant Medical Inc. contribute to the market through their expertise in precision engineering and regulatory compliance. Supportive government policies further foster innovation and research, making Europe a significant player in the global market. The region’s focus on high-quality engineering and strict adherence to regulatory standards positions it as a leader in producing reliable medical devices.

Europe’s edge in precision engineering is further bolstered by its strong research and development ecosystem. Government funding and incentives for healthcare innovation drive continuous advancements in medical technology. Companies in Europe benefit from extensive collaboration between industry, academia, and research institutions, facilitating the commercialization of cutting-edge technologies. Additionally, European outsourcing firms are adept at navigating complex regulatory environments, both within the continent and globally, ensuring that products meet rigorous safety and quality standards.

Asia Pacific: Emerging Growth Potential

Asia Pacific is rapidly emerging as a key player in the medical device outsourcing market, driven by expanding healthcare infrastructure and growing R&D investments. Countries like China, India, and Singapore are at the forefront, offering cost advantages and a skilled labor force. The region’s improving regulatory environment also enhances its appeal as a hub for medical device manufacturing and development. Companies in Asia Pacific benefit from lower production costs and access to a burgeoning market with increasing healthcare needs.

The rapid growth in healthcare infrastructure across the region is another major driver. Governments in Asia Pacific are heavily investing in healthcare to meet the needs of their growing populations. This translates into increased demand for medical devices and, consequently, for outsourcing services that can efficiently produce these devices. Moreover, the region’s focus on boosting local innovation through favorable policies and investment in research makes it a fertile ground for the medical devices outsourcing market, promoting a symbiotic relationship between local companies and international players.

Environmental Sustainability in Manufacturing

Sustainable Manufacturing Practices

As medical device companies become more environmentally conscious, there is a growing demand for sustainable manufacturing practices. Outsourcing partners that offer solutions such as recycled materials and energy-efficient processes are well-positioned to align with these sustainability goals. The shift towards eco-friendly production not only benefits the environment but also provides a competitive advantage to companies that prioritize sustainability. Firms that adopt these practices can better meet regulatory requirements and consumer expectations, enhancing their market reputation.

The implementation of sustainable manufacturing practices involves several key initiatives. Companies are increasingly adopting renewable energy sources, reducing carbon footprints, and minimizing waste through recycling and reusing materials. These initiatives not only contribute to environmental preservation but also optimize operational efficiencies, reducing costs in the long run. Outsourcing firms that lead in these areas can attract clients looking to bolster their environmental credentials, reinforcing the market trend towards sustainability.

Market Leaders in Sustainable Solutions

Leading companies in the medical device outsourcing market are increasingly adopting sustainable practices. For instance, firms are integrating renewable energy sources into their operations and investing in technologies that reduce waste and emissions. By prioritizing sustainability, these companies are not only meeting regulatory requirements but also enhancing their market reputation and consumer trust. This proactive approach towards environmental responsibility sets them apart in a highly competitive market.

Innovation in sustainable solutions is a continuing trend among market leaders. These companies are exploring ways to make every aspect of their production processes more environmentally friendly, from the sourcing of raw materials to end-of-life product disposal. By doing so, they not only comply with current environmental regulations but also set the bar for future industry standards. This focus on sustainability is not just about regulatory compliance; it reflects a broader commitment to corporate social responsibility, which increasingly influences consumer and partner choices in the healthcare industry.

Competitive Landscape and Innovation

Major Players and Market Dynamics

The medical device outsourcing market is highly competitive, with major players like Flex Ltd. and Celestica Inc. offering a wide array of services. These companies excel in contract manufacturing, design engineering, and regulatory compliance, providing comprehensive solutions to their clients. Emerging players such as Tecomet, Inc. are focusing on niche segments and strategic partnerships to gain market share. The intensifying competition is driving continuous innovation and quality improvements within the market, benefiting end-users and healthcare providers alike.

Market dynamics are shaped by several factors, including technological advancements, regulatory changes, and evolving consumer needs. Leading companies maintain their competitive edge by adopting the latest technologies and methodologies, ensuring they deliver cutting-edge solutions. This includes investing in research and development to stay ahead of market trends and anticipating future needs. As a result, clients benefit from reduced time-to-market and enhanced product innovation, while outsourcing firms enhance their market positions.

Innovations and Strategic Partnerships

Innovation is a key driver in the medical device outsourcing market. Companies are continuously exploring new technologies and methodologies to stay ahead of the competition. Strategic partnerships between medical device companies and outsourcing providers are crucial for fostering innovation. These collaborations enable the sharing of expertise and resources, accelerating product development and market entry. Strategic alliances often focus on joint research initiatives and co-developing new technologies, ensuring that both parties remain competitive.

Such partnerships are mutually beneficial, combining the strengths of manufacturing experts with the innovative capabilities of medical device companies. For example, a manufacturer with advanced 3D printing technology can collaborate with a medical device company focused on wearable health tech, resulting in new, innovative products that meet consumer demands. These symbiotic relationships are pivotal for driving the entire industry forward, as they enable faster development cycles, optimized resource allocation, and shared technological advancements.

Growth Drivers and Future Trends

Focus on Cost-Effective Manufacturing

In an age characterized by swift technological progress and rigorous regulatory standards, the medical device sector confronts significant challenges to innovate while staying cost-effective. The global medical device outsourcing market is becoming a powerful solution to these challenges. By utilizing specialized services, companies can more effectively navigate complex environments and concentrate on their core strengths. This growing market is anticipated to reach USD 232.8 billion by 2028, with an impressive compound annual growth rate (CAGR) of 11.2%.

Medical device outsourcing is transforming how companies manage innovation and expenses. By outsourcing, firms can access cutting-edge technology and expertise without incurring the high costs associated with in-house development. This allows organizations to allocate their resources more efficiently, ensuring compliance with regulatory standards while pushing forward with new advancements. The ability to outsource non-core activities enables companies to remain competitive in a rapidly evolving market, driving both innovation and cost savings.