The global demand for microchips has surged over recent years, propelled by technological advancements and increased reliance on digital infrastructure. With Asia leading the semiconductor industry, North America finds itself at a crossroads: continue its foreign dependence or step up and become a major player in microchip production. This article delves into North America’s readiness to compete on the global stage.

The Need for Supply Chain Resilience

North America’s Dependence on Asia

For decades, Asia, particularly Taiwan, South Korea, and China, has maintained a dominant position in the microchip manufacturing ecosystem. Taiwan Semiconductor Manufacturing Company (TSMC) is a significant leader, producing a substantial share of the world’s advanced semiconductors. This dominance has built a robust supply chain backbone for the tech industry but has also exposed its fragility. The onset of the COVID-19 pandemic underscored these vulnerabilities, leading to widespread disruptions in the semiconductor supply chain and highlighting the risks of heavy reliance on one region.

Moreover, the semiconductor shortage has had far-reaching implications, affecting various sectors from automotive to consumer electronics, and even defense. Companies and governments worldwide have faced the repercussions of delayed production schedules, increased costs, and missed opportunities. This scenario spotlighted the urgent need for diversification in the microchip supply chain. As a result, North America has started looking inward, scrutinizing its capacity to produce microchips domestically and its need to build a more resilient and autonomous supply chain.

Geopolitical Vulnerabilities

Beyond pandemics, geopolitical tensions play a significant role in exposing the vulnerabilities of relying heavily on Asian semiconductor markets. China’s increasing assertiveness towards Taiwan has induced concerns among the U.S. and its allies, compelling them to reassess their dependency on semiconductor supplies originating from this contentious region. The delicate geopolitical landscape amplifies the urgency for North America to establish a durable and self-reliant microchip manufacturing sector.

The potential risks associated with political conflicts, trade restrictions, and even potential military actions pose dire threats to the stability of global semiconductor supplies. Consequently, many Western nations are strategizing to redirect their focus towards regional supply chains, ensuring that critical technology components are secure from geopolitical unrest. The strategic imperative for North America, therefore, is to build a robust semiconductor ecosystem that will not only safeguard national security but also promote economic stability and technological advancement.

U.S. Strategic Initiatives

The CHIPS Act and its Implications

In response to the pressing need for an independent semiconductor sector, the U.S. enacted the CHIPS Act in 2022. This landmark legislation dedicates an unprecedented $70 billion to shore up the semiconductor industry, making a clear statement of America’s commitment to reclaiming its position in the global technology arena. These funds are meticulously allocated for expanding domestic manufacturing capabilities, accelerating scientific research, and fostering a workforce competent in sustaining this high-tech industry.

The CHIPS Act stands as a critical part of a broader strategy to mitigate risks associated with foreign dependencies and to bolster national security. The legislation not only aims to reduce the gap in microchip production capabilities between the U.S. and its Asian counterparts but also seeks to rejuvenate the entire technology sector. By establishing a foundation for long-term growth, the CHIPS Act endeavors to make the U.S. self-sufficient in semiconductor manufacturing, ensuring that the nation retains its competitive edge in global technological advancements.

Growing Investments and Economic Impact

The enactment of the CHIPS Act has catalyzed a wave of private investments, nearing $400 billion, announced by industry heavyweights like Intel and TSMC. These investments are pivotal in transforming the U.S. into a formidable competitor within the global semiconductor landscape. Arizona has particularly emerged as a microchip manufacturing hub, attracting substantial investments and attention. Major tech companies are constructing state-of-the-art facilities in the region, which is anticipated to create tens of thousands of jobs and stimulate localized economic growth.

The economic ramifications extend beyond job creation and facility construction. These investments have cascading effects on ancillary industries, such as equipment manufacturing, raw material supply chains, and even educational institutions that gear up to supply a skilled workforce. The economic uplift fosters community development, improves infrastructure, and ultimately reinforces America’s position as a tech innovation leader. However, the road ahead is not without challenges that require concerted efforts from both public and private sectors to harmonize initiatives and exploit opportunities effectively.

Mexico’s Strategic Role

Proximity and Cost-Effectiveness

Mexico’s geographic proximity to the United States, combined with its established reputation for cost-effective manufacturing, makes it an indispensable ally in North America’s semiconductor strategy. The country’s ability to provide labor-intensive manufacturing services at competitive prices significantly strengthens the North American semiconductor supply chain. This proximity allows for more efficient and rapid transport of goods, reducing logistical hurdles and ensuring a swift response to market demands.

Furthermore, Mexico’s participation in the United States-Mexico-Canada Agreement (USMCA) provides a robust framework that facilitates enhanced trade cooperation and investment in technology sectors. The synergy between the U.S. and Mexico benefits both economies, leveraging Mexico’s manufacturing capabilities while harnessing the technological prowess of the U.S. This complementary relationship is poised to fortify the regional supply chain, making it more resilient against global shocks. As companies seek to diversify their production bases, Mexico presents itself as a strategic and cost-effective solution.

Collaborations and Expansions

Leading electronics manufacturing service providers are not just eyeing Mexico for its cost advantages but are keen on establishing deep-rooted operations within the country. Foxconn’s expansion in Mexico illustrates this trend, with the company announcing new plants, including one in Guadalajara focused on producing Nvidia’s advanced superchips. These strategic moves highlight the collaborative efforts aimed at bolstering North America’s semiconductor production capabilities.

These investments are also fostering a local ecosystem of suppliers and service providers, creating a ripple effect that benefits regional economies. By partnering with Mexican firms, multinational companies gain access to a well-established manufacturing base while also contributing to the technological upliftment of the region. This collaborative approach also aids in fostering innovation and enhancing the overall competitiveness of North American semiconductor manufacturing. The synergy between the U.S. and Mexican industries ensures that North America will have a sustainable and competitive edge in the global semiconductor market.

The Global Semiconductor Market

Market Growth and Projections

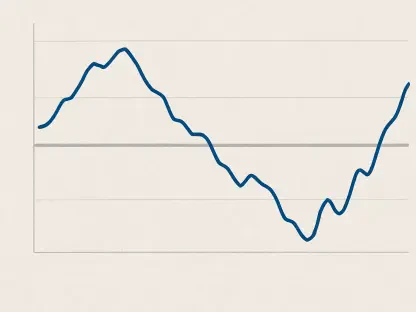

The global semiconductor market is witnessing exponential growth, projected to soar from $611.4 billion in 2023 to an astonishing $2.06 trillion by 2032. This surge is driven by escalating demands from burgeoning sectors such as renewable energy, electric vehicles, and cutting-edge AI technologies. These advancements underscore the indispensable role that semiconductors play in the modern economy, prompting regions worldwide to align their strategies to capture a share of this lucrative market.

The expected growth trajectory suggests that the tech industry’s reliance on semiconductors will continue to intensify. Consequently, the need to establish a balanced, multi-regional supply chain becomes even more critical. The projected boom offers North America a window of opportunity to claim a significant stake in this expanding market. However, achieving this goal will necessitate considerable investments in technology, innovation, and human capital. It will also require strategic policy frameworks that can adapt to the fast-paced evolution of the semiconductor industry.

Challenges and Regional Competitions

Despite North America’s ambitious initiatives to rejuvenate its semiconductor sector, it faces formidable competition from Asia’s deeply entrenched position. Countries like Taiwan, South Korea, and China have spent decades building a sophisticated and efficient semiconductor manufacturing ecosystem. Their well-established supply chains, combined with their technological advancements, present significant barriers for North America to overcome.

While investments and collaborations are enhancing North America’s capabilities, displacing Asia’s hegemony in the semiconductor market in the foreseeable future seems unlikely. However, the increased focus on building a regional supply chain represents a prudent and necessary step towards a more balanced and resilient global semiconductor ecosystem. The real challenge lies in sustaining momentum, continually innovating, and navigating the complex geopolitical landscape that surrounds the semiconductor industry.

Future Prospects and Challenges

Workforce Development and Innovation

Integral to North America’s strategy for becoming a semiconductor powerhouse is the development of a skilled workforce that can sustain the industry’s rigorous demands. Educational institutions, industry leaders, and government entities must collaborate to foster a pipeline of talent proficient in advanced manufacturing, research, and development. Initiatives aimed at enhancing STEM education, offering specialized training programs, and encouraging innovation are vital to creating a competent workforce capable of driving the sector forward.

Moreover, fostering an innovation-driven ecosystem is paramount for maintaining a competitive edge in this dynamic industry. This includes not only investing in cutting-edge research and development but also creating platforms for startups and small enterprises to thrive. By nurturing a culture of innovation and entrepreneurship, North America can ensure that it remains at the forefront of technological advancements in semiconductor manufacturing. Collaboration between academia, industry, and government will be critical in unlocking new potentials and addressing the multifaceted challenges inherent in this high-tech domain.

Long-Term Vision and Strategic Planning

The global demand for microchips has skyrocketed in recent years, driven by rapid technological progress and a growing reliance on digital infrastructure. As Asia continues to dominate the semiconductor industry, North America faces a critical decision: it can either maintain its dependence on foreign producers or take bold steps to emerge as a significant force in microchip manufacturing. This discussion explores North America’s preparedness and potential to compete at a global level.

Semiconductors are the backbone of modern technology, found in everything from smartphones and laptops to cars and medical devices. The COVID-19 pandemic further magnified the importance of a stable microchip supply, as supply chain disruptions led to shortages affecting various industries. Given this context, North America must assess its capability to become self-reliant.

Several factors influence North America’s readiness, including the availability of resources, investment in research and development, and government policies. Collaboration between public and private sectors can foster a robust ecosystem for innovation and production. Additionally, investing in education and training programs will be crucial to developing a skilled workforce capable of meeting the industry’s demands.

In summary, while Asia currently leads the microchip market, North America has the potential to rise as a formidable contender. By focusing on strategic investments, fostering innovation, and enhancing workforce skills, North America can reduce its dependency and secure a significant share in the global semiconductor arena.