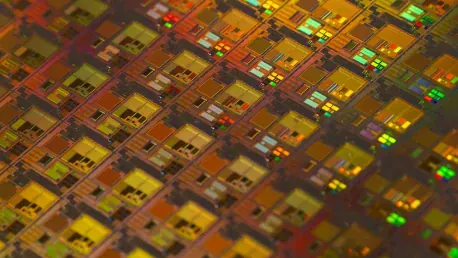

The United States is on the brink of a semiconductor renaissance, and Texas is poised to be at the forefront of this essential industry revival. Once a global leader in semiconductor research, design, and innovation, the U.S. saw its dominance wane over the past few decades. However, with strategic investments and policy support, there is a concerted effort to reclaim this critical sector. This article delves into the multifaceted approach to reviving U.S. semiconductor manufacturing, highlighting Texas’s pivotal role.

Background and Decline of U.S. Semiconductor Industry

Historical Leadership and Offshore Transition

In the wake of the microelectronics revolution, the U.S. held a commanding position in the global semiconductor market. For many years, America was synonymous with innovation and manufacturing in this vital field. However, the lure of cost advantages led to a gradual outsourcing of manufacturing processes to Japan and various countries in Asia. This offshore transition allowed companies to cut costs in the short term but resulted in a severe erosion of the U.S.’s semiconductor manufacturing capacity. Currently, the U.S. share of the global market hovers around a meager 10%.

The historical supremacy of the U.S. in semiconductor manufacturing is a stark contrast to today’s diminished market share. Initially, the U.S. controlled nearly 100% of the semiconductor industry, riding the wave of the microelectronics revolution with groundbreaking research and unparalleled manufacturing capabilities. As businesses sought cheaper production options, the industry gradually migrated offshore, first to Japan and later to other Asian countries like South Korea and Taiwan. This erosion not only diminished America’s market share but also impacted its industrial infrastructure, leading to a substantial loss of jobs and expertise in the semiconductor sector. The domestic capacity for semiconductor production weakened, causing the U.S. to become increasingly reliant on international suppliers.

Strategic and Security Implications

The offshoring phenomenon has not only impacted economic aspects but also raised significant national security concerns. Today, Taiwan leads the world in semiconductor production, accounting for approximately two-thirds of global output and over 90% of the most advanced chip manufacturing. While Taiwan remains a close ally, reliance on a single region, particularly one facing geopolitical tensions with China, exposes the U.S. to risks that extend beyond economics and into national security realms.

The strategic vulnerabilities inherent in the U.S.’s heavy reliance on foreign semiconductor production are multifaceted. Taiwan’s dominance in the industry is particularly precarious given the ongoing geopolitical tensions with China. Any destabilization in the region could severely disrupt the global supply chain, leaving the U.S. and other nations scrambling for essential components used in everything from smartphones to military equipment. Additionally, geopolitical events such as China’s aggressive posturing towards Taiwan and Russia’s invasion of Ukraine further complicate the supply chain for critical materials required in semiconductor manufacturing. Thus, the need to decentralize semiconductor production is not only an economic necessity but also a national security imperative, underscoring the importance of having a resilient, domestic semiconductor manufacturing capability.

Government and Educational Initiatives

The DARPA-UT Austin Partnership

In response to these vulnerabilities, notable efforts are being made to bring semiconductor manufacturing back to American soil. A standout initiative is the $1.4 billion collaboration between the Defense Advanced Research Projects Agency (DARPA) and the University of Texas at Austin. This partnership aims to establish the first U.S. hub for advanced microelectronics manufacturing. The Texas Institute for Electronics at UT Austin will serve as the epicenter for this groundbreaking endeavor, supported by significant investments from both DARPA and the state of Texas.

The DARPA-UT Austin collaboration represents a monumental stride in restoring the U.S.’s semiconductor capabilities. DARPA, known for its pioneering technological advancements, has committed $840 million from the Defense Department to support this initiative. Complementing this federal investment, the state of Texas has allocated $522 million to bolster the University of Texas at Austin’s Texas Institute for Electronics, which will house the new microelectronics manufacturing hub. This partnership aims to develop groundbreaking technologies and fabricate next-generation semiconductor solutions. By focusing on developing advanced manufacturing techniques within the U.S., the initiative seeks to mitigate the strategic risks associated with outsourcing and re-establish American preeminence in this critical field.

The CHIPS and Science Act of 2022

Foundational support for this resurgence comes from the CHIPS and Science Act of 2022, which allocated billions to boost microelectronics research, development, and manufacturing within the U.S. The act underscores a federal commitment to revive this critical industry. Through federal investments from the Defense Department and state contributions, Texas is uniquely positioned to spearhead this national effort, leveraging academic strengths and technological prowess.

The CHIPS and Science Act represents a crucial legislative framework designed to rejuvenate America’s microelectronics sector. Passed in 2022, the act earmarks significant funding for research, development, and domestic manufacturing of semiconductors. This legislative effort is aimed at reducing the country’s dependency on foreign semiconductor supply chains and fostering innovation on American soil. The act not only injects capital into the sector but also lays down a long-term strategic vision for sustained growth. It encourages public-private partnerships, like the DARPA-UT Austin collaboration, to foster technological advancements and create a secure, resilient semiconductor manufacturing infrastructure in the U.S. Texas, with its combination of academic excellence and business-friendly environment, stands out as a linchpin in this broader federal initiative.

Private Sector Investments

Major Companies’ Contributions

The private sector is also playing a critical role in this revitalization effort. Corporate giants like Samsung and Texas Instruments are committing billions of dollars to establish new semiconductor plants in Texas. These investments are laying down a robust infrastructure that is essential for re-establishing the U.S. as a leader in semiconductor manufacturing. The influx of capital and technology from these companies is catalyzing the growth and resilience of the semiconductor ecosystem in the region.

Samsung’s decision to build a new $17 billion semiconductor factory in Taylor, Texas, and Texas Instruments’ plan to invest up to $30 billion in new fabs in Sherman, Texas, highlight the substantial private sector commitment to this industry. These investments are not just financial; they also bring cutting-edge technology and operational expertise to Texas. Such large-scale projects are expected to create thousands of jobs, contributing to the local economy and further solidifying the state’s position as a hub for semiconductor manufacturing. These plants will not only increase domestic chip production but also stimulate ancillary sectors, including supply chain logistics, component manufacturing, and maintenance services, fostering a robust semiconductor ecosystem in Texas.

Educational Collaborations and Workforce Development

Moreover, Texas is fostering collaborations between industry and academia to ensure a well-prepared workforce. The Texas A&M Semiconductor Institute is pioneering efforts to expand research, education, and training, aligning workforce capabilities with industry demands. These educational initiatives ensure that the state’s semiconductor industry will have access to a skilled talent pool, ready to meet the evolving challenges and opportunities of the market.

Workforce development initiatives are critical to sustaining the growth of the semiconductor industry. Texas A&M Semiconductor Institute’s programs are tailored to address the industry’s specific needs, offering specialized courses in semiconductor design, fabrication, and testing. The institute collaborates with industry partners to ensure that its curriculum is aligned with current technological trends and future demands. Additionally, the institute’s focus on research provides students with hands-on experience, making them industry-ready upon graduation. Such initiatives are essential for creating a pipeline of skilled professionals who can support the semiconductor industry’s expansion and innovation, ensuring that Texas remains competitive on both a national and global scale.

Federal Government’s Support and Policies

Promoting Domestic and Foreign Investments

The federal government, under the Biden administration, is keen on promoting both domestic and foreign semiconductor manufacturers to set up operations within the United States. This multifaceted strategy aims to create a resilient semiconductor manufacturing sector by reducing dependency on foreign supply chains and fostering innovation through global partnerships. The overarching goal is to enhance national security while stimulating economic growth through substantial policy support and investment.

Efforts to attract foreign semiconductor companies to establish operations in the U.S. are part of a broader strategy to create a more resilient supply chain. Policies under the Biden administration aim to leverage incentives to encourage global leaders in semiconductor manufacturing to build facilities in the U.S. These measures include tax breaks, grants, and other financial incentives designed to make the U.S. an attractive destination for semiconductor investments. Such initiatives are intended to integrate foreign expertise and technology into the domestic landscape, fostering a collaborative environment that supports innovation and strengthens the overall semiconductor ecosystem. This approach ensures that the U.S. remains at the forefront of technological advancements while reducing vulnerabilities associated with over-reliance on foreign sources.

Legislative Framework and Long-Term Vision

Legislative efforts, exemplified by instruments such as the CHIPS and Science Act, are vital in setting the stage for long-term success. These policies provide the necessary framework for sustained growth and development in the semiconductor sector. By creating an environment conducive to research, innovation, and manufacturing, the federal government is laying a solid foundation for the resurgence of this strategically important industry.

The legislative framework established by the CHIPS and Science Act and other related policies serves as a cornerstone for the long-term vision of semiconductor industry revitalization. These legislative measures are designed to provide a comprehensive support system that includes funding, regulatory support, and infrastructure development. The goal is to establish a cohesive ecosystem that enables sustained innovation and manufacturing excellence. By fostering an environment where research institutions, private companies, and government agencies can synergize, these policies aim to drive technological advancements and economic growth. The federal government’s commitment is also reflected in long-term investments in education and workforce development, ensuring that the semiconductor industry has the skilled labor force required to thrive in an increasingly competitive global market.

Unified Effort Towards Semiconductor Resurgence

Strategic Collaborations and Investments

The journey to re-establish the U.S. as a semiconductor powerhouse is characterized by strategic collaborations and substantial investments. By bringing together government agencies like DARPA, academic institutions such as the University of Texas at Austin, and leading private companies, a comprehensive and unified approach is emerging. This multi-pronged strategy ensures that the semiconductor industry benefits from cutting-edge research, robust policy support, and a dedicated workforce.

Collaborations between these various entities are essential in creating an integrated ecosystem that fosters innovation and growth. Government agencies provide crucial funding and policy support, while academic institutions offer research capabilities and talent development. Private sector companies contribute technological expertise and operational experience. This collaborative approach ensures that all aspects of the semiconductor value chain are supported, from research and development to manufacturing and workforce training. By aligning the strengths of different stakeholders, this unified effort aims to create a more resilient and competitive semiconductor industry, capable of meeting both domestic and global demands.

Texas: The Cradle of Innovation

The United States stands on the cusp of a semiconductor revival, with Texas positioned to lead this crucial industry renewal. Historically, the U.S. was a global powerhouse in semiconductor research, design, and innovation. However, over the past few decades, this dominance has diminished. Now, with strategic investments and supportive policies, there’s a focused effort to regain leadership in this vital sector. Texas is playing a crucial part in this renaissance.

The resurgence is fueled by a combination of government initiatives, private sector investments, and collaborative efforts to bolster American semiconductor manufacturing and research capabilities. Companies and research institutions in Texas are at the helm, driving advancements and fostering a conducive environment for growth. The state’s favorable business climate, robust infrastructure, and a rich talent pool make it an ideal hub for semiconductor innovation. As the U.S. pushes forward, Texas’s role becomes increasingly significant, ensuring that the country not only catches up but reclaims its position as a leader in the global semiconductor landscape.