In a year marked by technological leaps and market fervor, Taiwan Semiconductor Manufacturing Company (TSMC) has emerged as a titan in the global semiconductor industry, with its stock price surging an astonishing 74% year-to-date to reach $185.20 on the New York Stock Exchange under the ticker TSM. This remarkable ascent has elevated TSMC’s market capitalization beyond $930 billion, securing its place among the top ten publicly listed companies worldwide. The driving force behind this meteoric rise is the insatiable demand for artificial intelligence (AI) and high-performance computing (HPC) infrastructure, positioning TSMC as the indispensable backbone of the tech revolution. Major industry players such as NVIDIA, Apple, and AMD rely heavily on TSMC’s cutting-edge manufacturing capabilities to power their innovations. With advanced production nodes like the 3-nanometer and 5-nanometer processes operating at over 95% capacity, even as demand for legacy chips wanes, the company’s critical role in shaping the future of AI and HPC is undeniable. Adding to the excitement, TSMC projects a staggering revenue range of $87 to $89 billion for the current year, fueled predominantly by AI-related sales. This financial outlook, combined with robust investor confidence in AI infrastructure stocks, paints a vivid picture of a company at the forefront of a transformative era. As the semiconductor landscape continues to evolve, a deeper exploration into the factors propelling TSMC’s success reveals a blend of financial strength, technological prowess, and strategic foresight.

Financial Dominance and AI Growth Momentum

TSMC’s financial performance in the current year stands as a testament to its market dominance, with second-quarter revenue reaching an impressive $20.8 billion, reflecting a substantial 34% increase compared to the previous year. A significant portion of this revenue, 28% to be exact, stems from AI wafer sales, highlighting the company’s pivotal role in meeting the burgeoning needs of the AI sector. The HPC division, which focuses on data center GPUs and custom AI silicon, reported a striking 40% year-over-year growth, a trend that CEO C.C. Wei describes as structural rather than fleeting. Projections indicate that AI-linked revenue could exceed $40 billion annually by 2026, underscoring the long-term potential embedded in TSMC’s business model. Beyond revenue, the company’s profitability metrics are equally compelling, with gross margins improving to 52.5% and net income jumping 36% to $7.6 billion in the same quarter. This financial robustness not only reflects TSMC’s ability to capitalize on high demand but also its efficiency in managing production costs amidst a competitive landscape.

Further bolstering investor trust is TSMC’s rock-solid balance sheet, which boasts cash reserves of $45 billion and a free cash flow margin exceeding 32%, figures that set it apart from industry peers like Intel and Samsung Foundry. This financial strength has enabled the company to enhance shareholder returns through a quarterly dividend of approximately $3.50 per share, offering a yield of 1.9%. Analysts view TSMC’s premium valuation of 24.3 times forward earnings as reasonable, given its unmatched growth trajectory and market position. Consensus price targets, ranging between $200 and $205, suggest a potential upside of about 10%, reflecting widespread optimism about the company’s ability to sustain its momentum. Unlike many competitors, TSMC has demonstrated resilience in rebounding from past downcycles, positioning it as a stable investment in a volatile sector. This combination of strong financials and promising forecasts illustrates why the company remains a favorite among institutional investors seeking exposure to the AI-driven semiconductor boom.

Technological Innovation as a Competitive Moat

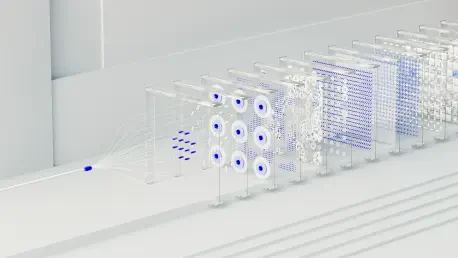

At the heart of TSMC’s success lies its unparalleled technological leadership, which continues to set industry standards in semiconductor manufacturing. The company’s 3-nanometer and 5-nanometer processes are widely regarded as global benchmarks, achieving yields above 90% and surpassing competitors like Intel and Samsung in both efficiency and consistency with extreme ultraviolet lithography techniques. This technological edge translates directly into market advantage, as TSMC meets the stringent demands of clients developing cutting-edge AI and HPC solutions. Looking ahead, the planned introduction of the 2-nanometer node, incorporating advanced Gate-All-Around transistor architecture, is slated for mass production by late 2026, promising even greater performance leaps. Additionally, the A16 node, expected to roll out in 2027 with Backside Power Delivery Network technology, aims to cut power consumption by 15% while boosting performance by 10 to 15%, further cementing TSMC’s position at the forefront of innovation.

To sustain this leadership, TSMC has committed a significant portion—70%—of its $32 to $36 billion capital expenditure for the current year to advanced technology nodes and AI infrastructure development. This strategic investment ensures that the company remains ahead in a highly competitive field where technological obsolescence is a constant threat. Each incremental advancement in manufacturing processes adds roughly 5 percentage points to gross margins, directly enhancing profitability. Unlike many peers who struggle with yield consistency in advanced nodes, TSMC’s proven track record in scaling production efficiently provides a substantial barrier to entry for competitors. This focus on innovation not only drives financial returns but also reinforces client trust, as major tech firms depend on TSMC to deliver the next generation of chips critical to their product roadmaps. The company’s forward-thinking approach in technology development continues to be a key pillar supporting its lofty market valuation and investor confidence.

Strategic Global Expansion and Risk Mitigation

Recognizing the geopolitical vulnerabilities tied to its heavy reliance on Taiwan for production—where 91% of output is currently concentrated—TSMC has embarked on an ambitious global expansion strategy to diversify its manufacturing footprint. Significant investments in the United States and Japan are underway, with the Arizona-based Fab 21 and Fab 22 complexes representing a $65 billion commitment, partly subsidized by the U.S. CHIPS and Science Act. These facilities are expected to begin mass production of 2-nanometer and 3-nanometer chips in 2026, marking a historic milestone in bringing advanced semiconductor manufacturing to American soil for clients like NVIDIA and Apple. Meanwhile, in Japan, the Kumamoto plant, developed in partnership with Sony and Denso, is ramping up output of 22- and 28-nanometer chips, with a second facility planned to produce 6-nanometer nodes for automotive and sensor applications by 2026. These efforts aim to reduce Taiwan’s share of production to below 60% by 2027, addressing critical supply chain concerns.

While the concentration of 60% of TSMC’s capacity within 100 miles of the Chinese coast poses a notable risk, particularly amid potential tensions in the Taiwan Strait, the company’s proactive diversification measures are designed to mitigate such threats. Support from the U.S. and Japanese governments, which view TSMC as a strategic asset, adds a layer of protection against geopolitical disruptions. Investors, however, continue to apply a modest 2 to 3% discount to the company’s valuation compared to U.S.-based peers due to these risks. Unlike firms solely dependent on a single region, TSMC’s multi-continental approach not only enhances supply chain resilience but also aligns with client demands for localized production. This strategic foresight in balancing growth with risk management highlights the company’s adaptability in navigating complex global dynamics, ensuring that it remains a trusted partner in the semiconductor ecosystem despite external uncertainties.

Market Sentiment and Future Outlook

Market sentiment surrounding TSMC remains overwhelmingly positive, as evidenced by strong institutional backing and technical indicators pointing to continued growth. Over 78% of the company’s shares are held by major institutional investors such as Vanguard, BlackRock, and Fidelity, signaling deep confidence in its long-term prospects. Foreign capital inflows into TSMC’s Taipei-listed shares reached $5.3 billion in the third quarter, marking the highest level in recent years. Insider sales have been negligible since early in the year, further reflecting management’s belief in sustained upward momentum. From a technical analysis perspective, the stock demonstrates a robust upward trend, with support at $178.40 based on the 50-day simple moving average and resistance at $192.10. The Relative Strength Index of 59 suggests room for additional gains before overbought conditions are reached, with a potential breakout above $192 paving the way toward the analyst consensus target range of $200 to $205.

Reflecting on the broader implications, TSMC’s journey showcases a unique blend of technological innovation, financial resilience, and strategic planning that has positioned it as a linchpin of the AI and HPC semiconductor supply chain. The remarkable 74% stock surge to $185.20 underscores its critical role in the tech revolution, while robust quarterly earnings of $20.8 billion and a projected revenue range of $87 to $89 billion affirm its market strength. Looking ahead, stakeholders can anticipate TSMC’s ongoing global expansion to further mitigate geopolitical risks, ensuring supply chain stability. Investors might consider monitoring the rollout of advanced nodes like the 2-nanometer process as a key indicator of sustained competitive advantage. As the semiconductor landscape evolves, TSMC’s ability to balance growth with risk management will remain a focal point for those seeking exposure to the AI-driven future of technology.