The intricate web of global technology, which powers everything from our handheld devices to the sprawling data centers that form the backbone of the digital economy, is fundamentally reliant on a market poised for explosive growth. A comprehensive market analysis reveals the global active electronic components market, valued at an estimated USD 342.7 billion in 2025, is on a trajectory to reach an astonishing USD 627.1 billion by 2034, expanding at a robust compound annual growth rate (CAGR) of 6.8%. This expansion is not merely a reflection of increased production but a testament to the deepening integration of sophisticated electronics into every facet of modern life. At the core of this growth are the active components themselves—the transistors, diodes, integrated circuits, and power semiconductors that act as the microscopic engines of progress, controlling the flow of electricity to amplify signals, process data, and manage power. The relentless demand from consumer electronics, the revolutionary shift toward electrified and autonomous vehicles, and the widespread adoption of industrial automation and advanced telecommunications infrastructure are the primary forces fueling this unprecedented surge, creating a complex and dynamic landscape for manufacturers and innovators alike.

A Market Defined by Key Trends and Dominant Players

The global active electronic components market is characterized by a distinct geographical hierarchy and the clear dominance of specific component segments, both of which are shaping investment priorities and competitive strategies across the industry. Geographically, the Asia Pacific region has firmly established itself as the market’s center of gravity, commanding an impressive revenue share of 39.6% in 2025. This leadership is not accidental but is the direct result of the region’s long-standing role as the world’s primary electronics manufacturing hub, home to a dense ecosystem of contract manufacturers, material suppliers, and assembly facilities that enable rapid, cost-effective production at a massive scale. Within this dominant region, China stands out as a critical national market, valued at USD 68.9 billion in 2024 and projected to reach USD 73.4 billion in 2025, solidifying its position as a key contributor. In stark contrast to Asia’s established dominance, North America is emerging as the fastest-growing region, with a projected CAGR of 7.4% through 2034. This accelerated growth is fueled by significant domestic investments in high-tech sectors, including the expansion of hyperscale data centers, the burgeoning electric vehicle industry, and a strategic push to relocalize critical semiconductor supply chains to enhance national economic security. This dynamic creates a fascinating global picture of an established manufacturing powerhouse in the East and a resurgent, innovation-driven challenger in the West, both contributing significantly to the market’s overall expansion.

Diving deeper into the market’s structure, the segmentation by component and technology type reveals the specific technological currents driving growth. The Integrated Circuits (ICs) segment holds the largest share of the market, accounting for a substantial 46.8% in 2025, a figure that powerfully illustrates the industry-wide megatrend of system miniaturization and functional integration. As consumer and industrial products become smaller, more powerful, and more complex, the need to consolidate dozens of functions—from processing and memory to wireless connectivity—onto a single, compact piece of silicon has become paramount. This trend is visible in everything from the latest smartphone to the advanced driver-assistance systems in a modern vehicle. From a technology perspective, the Power Electronics Components segment leads with a 34.2% market share, underscoring the universal and non-negotiable importance of efficient power management in all electronic systems. As devices become more powerful and energy costs remain a concern, the ability to convert, regulate, and distribute electricity with minimal loss is a critical design consideration. This need for efficiency is a primary driver of innovation and demand in the power electronics space, ensuring its continued dominance as a foundational technology across countless applications.

The Technological Shifts Redefining the Industry

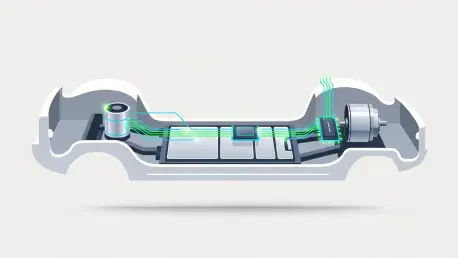

The active electronic components market is currently being reshaped by two powerful and transformative technological trends that are fundamentally altering the principles of electronic design and manufacturing. The first is a profound structural transition away from the use of discrete, single-function components toward the adoption of highly integrated, multi-functional semiconductor solutions. Historically, electronic systems were constructed by painstakingly assembling numerous individual components on a circuit board, a practice that inevitably led to increased physical size, greater complexity, higher potential for power loss, and longer design cycles. The contemporary landscape, however, demands a more elegant and efficient approach. System manufacturers are now aggressively prioritizing sophisticated solutions like integrated circuits, mixed-signal architectures, and particularly System-on-Chip (SoC) designs. These advanced platforms embed a vast array of functionalities, such as central processing, graphics processing, memory, and wireless radios, into a single, compact physical footprint. This shift toward integration yields a multitude of compelling benefits, including dramatic improvements in power efficiency, enhanced signal quality and integrity by shortening data pathways, and substantial cost savings at the total system level. Consequently, this design philosophy has become indispensable for a wide array of applications where space, power consumption, and cost are critical constraints, such as in consumer electronics, advanced automotive systems, and complex industrial control systems.

The second major trend galvanizing the market is the rapid and widespread adoption of advanced power electronics, a surge directly linked to the global macro-trends of electrification, sustainability, and decarbonization. The worldwide movement to transition away from fossil fuels is creating unprecedented demand for high-performance power semiconductor devices. This is most visible in the automotive sector’s shift toward electric vehicles (EVs), but it extends far beyond that to include the expansion of renewable energy systems like solar and wind farms, the necessary build-out of a robust fast-charging infrastructure, and the persistent push for greater energy efficiency in industrial equipment. All of these applications require components specifically engineered to handle high voltages, manage significant power levels, and dissipate considerable thermal loads reliably and efficiently. The invention and commercialization of next-generation technologies in power electronics, particularly those based on wide-bandgap materials like silicon carbide (SiC) and gallium nitride (GaN), have opened up new avenues for growth and performance. These innovative materials significantly improve energy conversion efficiency, drastically reduce the amount of energy wasted as heat, and substantially strengthen overall system reliability compared to traditional silicon. In essence, advanced power electronic components have become the crucial enablers of global electrification efforts and the development of next-generation power management solutions.

Navigating Market Forces: Drivers, Restraints, and Opportunities

The upward trajectory of the active electronic components market is being significantly influenced by a complex interplay of powerful drivers, potential inhibitors, and emerging opportunities that will collectively define the competitive landscape in the coming years. A primary factor accelerating the growth of local manufacturing capacity is the recent emergence of government-led semiconductor sovereignty initiatives. Driven by a combination of geopolitical considerations, supply chain vulnerabilities exposed in recent years, and a strategic desire to reduce dependency on foreign imports for these critical technologies, governments in major economic blocs are launching large-scale, well-funded policy programs. These initiatives are specifically designed to promote and incentivize the domestic manufacture, assembly, and advanced packaging of active components. For instance, the United States has implemented the CHIPS and Science Act, a landmark piece of legislation that provides substantial federal funding and attractive tax incentives to encourage the establishment and expansion of domestic semiconductor fabrication facilities. In a parallel move, the European Union has launched the European Chips Act, an ambitious plan aimed at significantly increasing the region’s share of global semiconductor production and building a more resilient and self-sufficient supply chain. These strategic, state-sponsored programs are creating a powerful tailwind for market growth by stimulating massive new investments in local production capacities.

Conversely, a major force acting as a significant inhibitor to seamless market growth is the ongoing tightening of export controls and trade regulations that govern the cross-border flow of electronic components and semiconductors. Citing strategic considerations related to national security, governments have been increasingly implementing stringent and complex regulations on the trade of highly advanced electronic components and the sophisticated equipment used to manufacture them. A prominent example of this trend is the U.S. Export Administration Regulations (EAR), under which strict controls have been applied to the export of certain leading-edge semiconductor technologies and related components to specific countries and entities. These regulatory measures, while intended to protect national interests, create significant challenges and friction for the highly globalized semiconductor industry. They can lead to severe bottlenecks in the global supply chain, substantially increase the length and complexity of approval cycles for international transactions, and ultimately reduce market access for manufacturers and distributors by limiting their geographical reach and customer base. The resulting uncertainty and compliance burdens can act as a significant headwind, slowing the pace of global trade and collaboration in the sector.

Amidst these competing forces, a highly promising opportunity for sustained market growth lies in the rapid and seemingly endless expansion of hyperscale data centers and the broader digital infrastructure footprint around the world. Major cloud service providers, content delivery networks, and large information technology companies are aggressively scaling their data center operations to meet the explosive global demand for services such as cloud computing, high-definition video streaming, artificial intelligence processing, and broad-based digital transformation initiatives across all industries. The construction and continuous operation of these massive, power-hungry facilities create a huge and sustained demand for a wide range of active electronic components. Specifically, advanced integrated circuits, high-efficiency power semiconductors, and precise signal processing components are required in vast quantities to ensure stable and redundant power management, facilitate high-speed data transfer with low latency, and maintain trouble-free system operations under demanding 24/7 conditions. As the digital economy continues its relentless expansion and generates ever-increasing volumes of data, so too will the demand for the active components that serve as the fundamental building blocks of its core infrastructure, presenting a durable and long-term growth opportunity for the industry.

A Global Snapshot of Regional Market Dynamics

A deeper examination of the global market reveals distinct regional characteristics, with each major geography contributing uniquely to the overall market landscape and growth narrative. The Asia Pacific region’s established leadership is anchored not only in its status as the global epicenter of electronics manufacturing but also in its highly integrated and resilient supply chain ecosystem. The region’s immense production volumes of consumer devices, combined with the deep embedding of active components in smartphones, computing hardware, and industrial electronics, drive a colossal and sustained demand. Structural advantages, including the presence of the world’s largest contract manufacturers and a vertically integrated supply chain, enable faster product development cycles and greater cost-effectiveness, reinforcing its market dominance. Within this powerhouse region, China is a critical driver, fueled by its expansive integrated-circuit electronics manufacturing base and immense domestic demand. Its strong downstream industries—including consumer electronics, electric mobility, and telecommunications—create a voracious appetite for ICs and power semiconductors, while continuous capacity expansion by local manufacturers strengthens its position as a key global revenue contributor.

In contrast, North America and Europe represent a combination of high-growth momentum and established industrial strength. North America’s position as the fastest-growing region, with a projected CAGR of 7.4%, is fueled by a surge of investment in data centers, electric vehicles, and advanced industrial automation. The high penetration of high-performance, energy-efficient electronic systems in these sectors drives strong demand for advanced power electronics and cutting-edge ICs. The region’s world-renowned innovation capabilities, centered in hubs like Silicon Valley, coupled with a growing strategic emphasis on localizing component supply chains, further bolster its market growth prospects. The European market, meanwhile, is expanding steadily, primarily fueled by the increasing adoption of sophisticated electronics in its world-class automotive applications, industrial automation, and renewable energy infrastructure. A strong regional emphasis on electric vehicles, the intelligent factory concept of Industry 4.0, and the development of efficient power grid solutions is fueling the adoption of high-reliability ICs, power semiconductor devices, and optoelectronic components. The tight collaboration between component suppliers and end-use manufacturers, particularly in the German automotive and industrial sectors, helps accelerate design-in cycles and secure long-term supply agreements, ensuring steady and predictable growth.

Emerging markets in Latin America and the Middle East & Africa (MEA) represent the next frontiers for growth in the active electronic components market, though from a smaller base. The market in Latin America is gaining pace, supported by rising local electronics assembly operations, ongoing telecommunication infrastructure upgrades, and a growing automotive industry in key countries such as Brazil, Mexico, and Argentina. The development of local electronics production capabilities and strategic government initiatives aimed at improving data connectivity are triggering higher demand for both foundational and advanced semiconductors and power devices. Brazil’s market growth, for instance, is driven by its expanding consumer electronics and automotive sectors, where rising local production of appliances, smartphones, and automotive modules propels the adoption of ICs and discrete semiconductors. In the MEA region, the market is growing due to the accelerated development of digital infrastructure, broad industrial diversification efforts away from traditional industries, and large-scale energy projects. The increased deployment of modern telecommunication networks, ambitious smart city projects, and the wider adoption of industrial automation are creating a growing need for high-performance electronic components to power this regional transformation.

An In-Depth Look at Market Segments

A granular analysis of the market broken down by component type, technology type, and end-use application provides deeper insights into the specific areas of growth and dominance that define the industry’s internal dynamics. When viewed by component type, Integrated Circuits (ICs) clearly hold the largest market share, capturing 46.8% of the market in 2025. This dominance is a direct and logical consequence of the overarching industry trend toward miniaturization, where a diverse range of electronic functionalities that once required multiple discrete components are now consolidated into small, highly efficient, and cost-effective single-chip solutions. This trend is central to the design of virtually every modern electronic device. In compelling contrast, the Power Semiconductor Devices category is projected to grow at the fastest rate, with an estimated CAGR of 7.9%. This rapid growth is directly attributable to their increasing deployment in high-growth, high-power applications such as electric vehicles, renewable energy solutions, and industrial systems. These applications consume large amounts of power and require sophisticated, reliable, and highly efficient power conversion and high-voltage handling capabilities, making advanced power semiconductors an indispensable enabling technology.

Examining the market through the lens of technology type, Power Electronics Components have cemented their position as the dominant segment, commanding the largest value share of 34.2% in 2025. This leadership is due to the fundamental and universal importance of these components in enabling efficient power conversion, precise voltage regulation, and overall energy efficiency across nearly all electronic systems, from the smallest wearable device to the largest industrial motor. Close behind in terms of growth potential, the Mixed-Signal Components segment is expected to register the highest growth over the forecast period. Its rapid expansion is spurred by the increasing need for components that can seamlessly and accurately interface between the analog physical world and the digital processing world within a small physical footprint. Such capabilities are essential for modern consumer electronics, which rely on sensors and analog inputs, as well as for automotive electronics and advanced communication systems. Finally, when segmented by end-use application, the Consumer Electronics market is expected to witness the fastest growth, with a projected CAGR of 6.5%. This growth is fueled by the relentless and cyclical consumer demand for smartphones, wearable technology, home automation devices, and personal computers. As consumers continuously desire smaller, faster, and more power-efficient devices, the density and sophistication of active electronic components within these products will continue to increase, consistently driving market growth.

A Competitive Landscape Forged by Innovation and Strategy

The global active electronic components market was characterized as moderately consolidated, populated by large, multinational semiconductor manufacturers operating alongside a vibrant ecosystem of specialized component suppliers. A select group of leading players commanded a major share of the market, effectively leveraging their wide product portfolios, advanced global manufacturing capacities, and deep-rooted, long-standing relationships with original equipment manufacturers (OEMs) across key industries. Industry participants actively competed to strengthen their market positions through a variety of well-defined strategies, including continuous and aggressive capacity expansion, strategic portfolio diversification, the securing of long-term supply agreements to ensure stability, and engaging in high-value strategic mergers and acquisitions to gain access to new technologies or markets. This environment fostered a climate of intense competition and rapid innovation as companies vied for technological leadership and market share in one of the world’s most critical industries.

In this dynamic environment, several key players made significant strategic moves that shaped the competitive landscape. Pragmatic Semiconductor, an innovative UK-based firm, emerged as a disruptive force with its cutting-edge flexible semiconductor platforms when it introduced the Pragmatic FlexIC Platform Gen 3 in March 2025, a next-generation flexible ASIC platform with mixed-signal functionality. In the same month, Intel Corporation expanded its portfolio by unveiling new GPUs for professional workstations and AI inference, tailored for high-growth enterprise workloads. Demonstrating the geopolitical influence on strategy, Taiwan Semiconductor Manufacturing Company (TSMC) announced plans to significantly boost its investment in U.S.-based advanced semiconductor manufacturing, committing an additional USD 100 billion to increase production capacity on American soil. Meanwhile, Magnachip Semiconductor Corporation launched two new 6th-generation 650V Insulated Gate Bipolar Transistors (IGBTs) for solar inverters and industrial power systems, achieving significant gains in efficiency. Reinforcing the importance of R&D, Samsung Electronics hosted its AI Forum in September 2025, showcasing its advancements in intelligent semiconductor technologies and reinforcing its commitment to collaborative innovation. These actions, undertaken by industry giants and emerging innovators alike, illustrated the key strategies that drove progress and defined market leadership.