A global manufacturing revolution powered by green technology is well underway, promising trillions in economic value, but the United States is conspicuously absent from the winner’s circle. While other nations, most notably China, have embraced this transformation as a powerful engine for economic growth and industrial dominance, current U.S. policy appears adrift. Marked by unstable trade measures and a prevailing skepticism toward green innovation, the nation’s strategy is not only failing to capture this momentous opportunity but is actively undermining its own potential for a manufacturing renaissance. The result is a stark and growing divergence, where a massive economic boom is happening globally, yet the benefits are largely bypassing American shores. This critical analysis reveals the deep-seated flaws in the current approach and outlines a comprehensive, alternative path toward rebuilding a competitive domestic industrial base.

A Tale of Two Strategies

The strategic chasm between the United States and China is most pronounced in their respective approaches to green technology. While prevailing U.S. policy has often characterized green initiatives as an unproven and costly endeavor, China has decisively demonstrated that the sector is a formidable driver of economic prosperity. This reality is reflected in China’s commanding global leadership in the manufacturing of solar panels, batteries, and electric vehicles. The sheer scale of this commitment is staggering, exemplified by projects like Chinese automaker BYD’s construction of an EV plant that dwarfs its international competitors, including being seven times larger than Tesla’s biggest gigafactory. This aggressive investment and industrial mobilization underscore a clear and powerful truth: the green manufacturing boom is not a theoretical concept but a potent economic force that is actively reshaping the global industrial landscape, largely without significant American participation at the forefront.

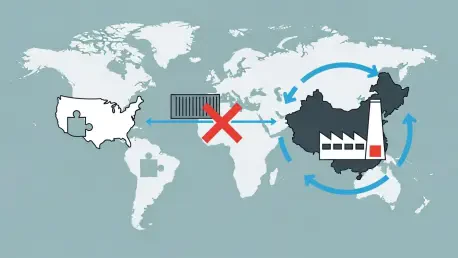

Beyond its embrace of green technology, China’s strategic foresight is also evident in its nuanced response to ongoing trade disputes with the United States. Rather than engaging in a direct, retaliatory conflict with its largest customer, China has opted for a more sophisticated, long-term strategy. The focus has shifted inward, toward fortifying its domestic economy and securing its complex supply chains to insulate itself from the volatility of international trade pressures. This deliberate pivot is designed to mitigate the potential damage from a deteriorating relationship with the U.S. and systematically reduce its long-term reliance on American consumers. By doing so, China is not merely weathering a storm but is strategically repositioning its entire economy for greater resilience and self-sufficiency, showcasing a level of long-range industrial planning that stands in sharp contrast to more reactive Western policies.

The Crippling Effects of Flawed Tariffs

For venture capitalists and entrepreneurs attempting to fuel a resurgence in American deep-tech manufacturing, the current U.S. tariff policy has proven to be a significant impediment. While tariffs can be a legitimate tool of economic statecraft, their present implementation is characterized by three critical and destructive flaws, the first of which is profound instability. The unpredictable and often sudden imposition of these trade barriers actively punishes and deters the very domestic investment the country seeks to encourage. A business cannot confidently commit billions of dollars to build a new factory on U.S. soil when the threat of an overnight tariff on essential, best-in-class machinery from a country like Germany or Japan looms large. Such a move could instantly render a carefully planned project financially unviable, effectively bankrupting the effort to reshore production and destroying the long-term confidence required for bold, transformative industrial investments.

Compounding the issue of instability, the tariffs are also defined by their excessive size and inherent arbitrariness. The imposition of high tariffs creates what industry experts call “expensive discoordination,” a chaotic scenario where businesses are forced to abruptly halt production and scramble to find alternative, often inferior or more costly, suppliers. This scramble incurs significant costs from supply chain disruptions and operational uncertainty, which can quickly erode or eliminate profit margins entirely. Crucially, as virtually no nation besides China can source its entire supply chain domestically, tariffs on foreign inputs directly inflate the cost of producing goods within the United States. Furthermore, when these policies are applied erratically and without clear, guiding principles, it becomes impossible for investors and business leaders to discern the government’s long-term industrial strategy, making it exceedingly difficult to commit the vast capital and resources necessary to establish robust domestic production lines.

A Blueprint for an American Comeback

A viable strategy to revitalize the U.S. industrial base must begin with an honest acknowledgment of the fundamental economic realities facing a high-income nation. With inherently higher labor costs compared to developing economies, the United States can only achieve global competitiveness through one of two primary pathways: either by achieving superior individual worker productivity, which effectively lowers the labor cost per unit of output, or by manufacturing superior-quality goods that can command a higher price and generate healthier margins. Both of these paths, however, converge on a single, indispensable requirement: the presence of a highly skilled, exceptionally trained, and adaptable workforce. Consequently, the absolute core of any successful and sustainable industrial policy must be a comprehensive and unwavering long-term commitment to the development of human capital, as it is the ultimate determinant of a nation’s productive capacity.

To cultivate the world-class workforce necessary for an industrial revival, the government must adopt a multi-pronged strategy centered on profound investment in education. This commitment cannot be superficial; it requires a deep and sustained effort to lower the cost and simultaneously improve the quality of all educational avenues. This includes four-year universities, advanced degree programs, specialized trade schools, and regional craft guilds that provide hands-on training. For a program of “mass-upskilling” to succeed, the people, places, and tools dedicated to this mission must be well-resourced and, just as importantly, socially respected. This will necessitate a significant cultural shift, including providing higher compensation for teachers and trainers to attract top talent to the profession. This foundational investment in people is not merely a component of a larger strategy; it is the non-negotiable prerequisite for building a globally competitive industrial base in the 21st century.

The Path Forward Demanded a New Foundation

This educational imperative had to be supported by two other critical pillars: modernized infrastructure and a completely overhauled trade policy. The nation needed to commit to upgrading its physical backbone—its roads, bridges, and ports—while also ensuring its industries had access to lower-cost and reliable energy. The erratic and punitive tariff system was replaced with an approach that was fundamentally stable, low, and principled. A guaranteed, low tariff of 5 to 10 percent, locked in for a decade, provided the predictability that investors required to finance new factories. It also sent a clear signal to the workforce that investing their time and effort into re-skilling for these new manufacturing careers was a secure, long-term professional move. This strategic vision understood that the formula for industrial revitalization was never a secret. Success ultimately hinged on a nation’s willingness to make intelligent, sustained investments in its foundational strengths: its people, its infrastructure, and a stable policy environment that encouraged, rather than punished, long-term growth.