Securing Tomorrow’s Technology: The Push for American Rare Earths

In a landmark move to fortify its industrial and defense capabilities, the United States government has announced a $1.6 billion investment in USA Rare Earth, a private company poised to develop a domestic supply chain for critical minerals. This substantial financial commitment, aimed at reducing America’s heavy reliance on foreign nations, signals a pivotal moment in the global race for technological supremacy. This article explores the strategic motivations behind this investment, the historical context that made it necessary, and the broader implications for the future of the high-tech and defense industries. By examining the anatomy of the deal and the challenges ahead, we can better understand this bold step toward achieving American mineral independence.

From Global Leader to Dependent Nation: The History of U.S. Rare Earth Production

The current American dependency on foreign rare earth elements is a stark reversal of its historical position. For decades, the U.S. was the world’s leading producer, primarily through the Mountain Pass mine in California. However, beginning in the 1980s, production began shifting overseas, drawn by China’s lower labor costs and less stringent environmental regulations. This migration accelerated until China established a near-monopoly, a strategic dominance it has maintained for years. Today, China processes over 90% of the world’s supply of these 17 critical minerals, which are indispensable components in everything from smartphones and electric vehicle motors to sophisticated military hardware like fighter jets and missile guidance systems. This profound reliance has been identified by U.S. policymakers as a critical national security vulnerability, creating a strategic chokehold that could be exploited in times of geopolitical tension.

Unpacking the $1.6 Billion Bet: Strategy, Stakes, and Challenges

From Mine to Magnet: The Anatomy of the USA Rare Earth Investment

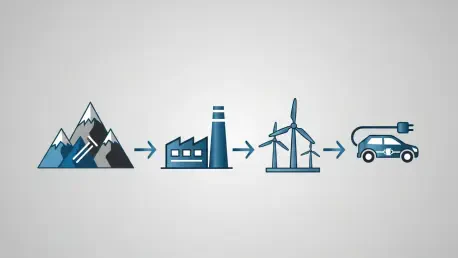

The $1.6 billion investment is a meticulously structured public-private partnership designed to build an end-to-end domestic supply chain. Facilitated by the Commerce Department’s CHIPS program, the package includes $277 million in direct federal funding and a substantial $1.3 billion loan. In return for this support, the U.S. government will acquire a minority stake of 16.1 million shares in USA Rare Earth, with rights to purchase an additional 17.6 million. The funds are earmarked for two key projects: advancing a rare earth mine in Texas and constructing a state-of-the-art magnet manufacturing facility in Oklahoma. This “mine-to-magnet” approach is crucial, as it addresses not only the extraction of raw materials but also the complex and highly specialized processing and manufacturing stages where China’s dominance is most pronounced.

A Coordinated National Effort: Beyond a Single Investment

The investment in USA Rare Earth is not an isolated event but the latest and most significant move in a broader, government-wide strategy to onshore critical mineral supply chains. This concerted push underscores a bipartisan consensus that mineral independence is a top national priority. Other recent initiatives paint a clear picture of this trend, including the Pentagon’s $400 million investment in producer MP Materials to bolster its operations. Furthermore, the government has forged a $1.4 billion partnership with startups Vulcan Elements and ReElement Technologies to develop innovative processing techniques. This multi-pronged approach, spanning various federal agencies and supported by legislative proposals to stockpile minerals, demonstrates a clear, long-term commitment to rebuilding a robust and secure domestic industry from the ground up.

The Uphill Battle: Overcoming Economic and Environmental Hurdles

Despite the infusion of federal capital, establishing a competitive American rare earth industry faces formidable challenges. For decades, China has leveraged state subsidies and a massive scale of production to keep global prices low, creating a high barrier to entry for Western competitors. U.S. companies must also navigate stringent environmental regulations and higher labor costs, factors that contributed to the industry’s initial decline. The timeline for developing new mines and processing facilities is long and capital-intensive, requiring sustained investment and political will. Successfully competing with China’s entrenched supply chain will demand not only funding but also technological innovation in cleaner extraction and more efficient processing to make domestic production economically viable and environmentally sustainable in the long run.

Forging a New Supply Chain: The Future of Critical Minerals

Looking ahead, the U.S. strategy is likely to evolve beyond direct investments into a more integrated industrial policy. This will probably include continued use of the Defense Production Act to fast-track projects, further funding for research into recycling and alternative materials, and a focus on building a skilled workforce. A key trend will be the pursuit of “friend-shoring,” where the U.S. collaborates with allied nations like Australia, Canada, and Japan to create a diversified, resilient, and transparent global supply chain free from the influence of geopolitical rivals. Technological innovation will be paramount, with a push for new methods that reduce the environmental impact of mining and processing, potentially giving U.S. producers a competitive edge in an increasingly eco-conscious global market.

Strategic Takeaways for Industry and Policymakers

The major takeaway from this recent wave of investment is that the U.S. is unequivocally committed to reducing its critical mineral vulnerabilities. For businesses, this creates significant opportunities across the supply chain, from exploration and mining to advanced materials science and manufacturing. Companies in the EV, renewable energy, and defense sectors should actively monitor these developments to secure their future supply lines. For policymakers, the key is to maintain momentum, ensuring that regulatory frameworks support responsible domestic production without unnecessary red tape. The strategy must remain consistent and well-funded to provide the long-term certainty that private investors need to commit the massive capital required to build this new industrial ecosystem.

The High Stakes of Mineral Sovereignty

The $1.6 billion investment in USA Rare Earth is more than just a financial transaction; it is a foundational piece in America’s strategy to secure its economic and national security for the 21st century. By tackling its deep-seated dependence on China for materials that power modern life, the U.S. is making a generational bet on its own industrial capacity and innovation. This initiative highlights the undeniable reality that in today’s world, control over critical supply chains is a direct measure of geopolitical power. The path to achieving true mineral sovereignty will be long and challenging, but it is a race the United States has decided it can no longer afford to lose.