ASML, a prominent Dutch company, has cemented its position as an essential player in the AI industry by revolutionizing chip manufacturing processes through its exclusive production of extreme ultraviolet (EUV) lithography machines. ASML provides crucial technology for crafting advanced chips vital for AI applications. As these high-performance chips are integral to the rapid growth of artificial intelligence, ASML’s monopoly over this technology makes it an indispensable asset in the tech industry. With its profound impact and strategic positioning, ASML represents a significant investment opportunity in the evolving AI landscape. Amidst ongoing geopolitical tensions and competitive valuations, the company continues to drive innovation and shape the future of AI technology.

ASML’s Monopoly in EUV Lithography Technology

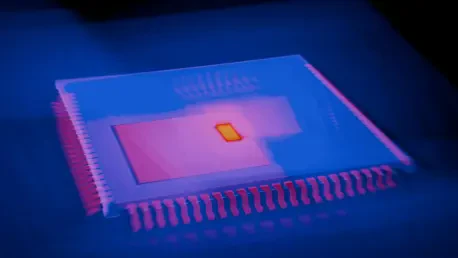

The Core of Semiconductor Manufacturing

ASML’s unrivaled dominance in EUV lithography technology arises from its sophisticated systems that utilize 13.5 nm wavelength light to create intricate patterns on silicon wafers. This process is fundamental for the production of cutting-edge chips crucial for AI companies aiming to deliver ever-more advanced computational capabilities. By pushing the envelope with chips that have sub-2 nanometer nodes, companies such as Taiwan Semiconductor Manufacturing (TSM), Intel, and Nvidia rely heavily on ASML’s technology to keep pace with the demand for AI acceleration. This specialized lithography not only facilitates greater precision in chip design but also ensures higher performance and energy efficiency, making ASML an irreplaceable component in the semiconductor supply chain.

ASML’s strategic hold on this technology has solidified its monopoly over the market, with a market cap reaching approximately $300 billion. This position has been bolstered by consistent investments in research and development, thereby setting high barriers to entry for potential competitors. However, this technological leadership does not come without challenges. The intricacy of EUV technology demands substantial investment and maintenance costs, posing risks to profit margins. Despite these challenges, ASML’s commitment to refining its technology continues to meet the evolving demands of AI infrastructure, underscoring its pivotal role in the tech industry’s roadmap.

Navigating Geopolitical and Market Challenges

While ASML enjoys a near monopoly in its domain, it faces potential disruptions from increasing geopolitical tensions, notably the US-China trade relations. China’s significance in ASML’s sales accounts for a substantial portion of its revenue, making the company vulnerable to shifts in international trade policies. Nonetheless, ASML’s autonomous growth strategy, driven by rising global demand for AI infrastructure, equips it to offset potential geopolitical setbacks. In an environment of supply chain complexities and fluctuating market dynamics, ASML remains steadfast in its pursuit of innovation and growth.

The global semiconductor landscape is marked by intricate supply chains, and ASML is no exception. Its reliance on a wide network of suppliers and partners across the world presents challenges in ensuring uninterrupted production and maintenance of its high-tech machinery. Moreover, the high costs associated with continuous R&D demand careful financial management to balance innovation and profitability. While ASML’s stock is traded at a premium, reflecting investor confidence in its potential, the company must judiciously navigate these hurdles to maintain its competitive edge. As the industry evolves, ASML’s strategic foresight and adaptability will be critical in managing the complexities of a globalized market.

Long-Term Investment Potential of ASML

Sustaining Growth in Evolving AI Ecosystem

ASML’s indispensable role in the AI-driven semiconductor industry highlights its potential as a long-term investment prospect. As AI technologies continue to advance, the demand for high-performance chips will foreseeably grow, affirming ASML’s position at the heart of this evolution. The company’s continued investment in EUV technology and potential emerging innovations make it a promising asset for investors. By catering to the expanding needs of major tech companies, ASML cements its role as a cornerstone of modern computing advancements, urging investors to consider it a pivotal stock within their portfolios.

Despite the inherent risks associated with technological industries, including potential competitors venturing into alternative lithography technologies, ASML’s established infrastructure and market dominance position it as a stable player. Its comprehensive engagement with top semiconductor and technology firms echoes its resilience and capacity to contribute significantly to the growth in computational power demands. Therefore, ASML’s vision of harnessing its exclusive technology to fuel the AI industry’s expansion resonates strongly with both industry insiders and market analysts, consolidating its image as a key investment opportunity with enduring prospects.

Future Directions and Considerations

In contemplating ASML’s future trajectory, one must note the evolving landscape of AI and semiconductor technologies. The company is expected to explore partnerships and innovations that extend beyond traditional lithography. Maintaining a keen focus on technological advancements, ASML aims to diversify its equipment offerings to meet broader market needs. This proactive approach not only safeguards its leadership in EUV technology but also positions it to seize new opportunities in other emerging sectors within the tech industry.

Balancing operational expansion with sustainability will be paramount as ASML navigates future challenges. While its technological prowess remains its strength, attention to environmental and ethical responsibilities will likely influence ASML’s reputation and market standing. As global demand for sustainable technology solutions grows, ASML’s commitment to responsible innovation could become a distinguishing factor in its continued success. Strategically leveraging its resources and expertise, ASML is poised to remain a central figure in shaping the future of AI and semiconductor industries.

ASML’s Indispensable Role in AI Future

ASML, a leading Dutch company, has established itself as a key player in the artificial intelligence (AI) sector by transforming how chips are manufactured. It holds a unique position through its exclusive production of extreme ultraviolet (EUV) lithography machines, providing essential technology for making advanced chips critical to AI applications. These high-performance chips are central to the swift development of AI, making ASML’s control over this technology a strategic asset in the tech industry. The company’s impact is profound, and its strategic positioning marks it as a significant investment opportunity in the ever-evolving AI landscape. Despite ongoing geopolitical challenges and competitive market assessments, ASML continues to spearhead innovation and influence the direction of AI technology. Its role in the industry remains pivotal as it shapes the future, navigating the complexities of global relations while promoting advancements in chip manufacturing that power AI’s relentless progression.