In a landscape where manufacturing technology is rapidly evolving, Divergent Technologies has emerged as a focal point of attention with its recent Series E funding round, amassing an impressive $290 million and pushing its valuation to a striking $2.3 billion. This financial achievement, far from being just a headline number, reflects a profound belief among investors in the transformative potential of additive manufacturing (AM) and advanced production systems. The capital injection positions Divergent at the forefront of innovation within high-stakes industries such as aerospace, defense, and automotive. However, beneath the surface of this financial triumph lie critical questions about the company’s proprietary technology, strategic alignments, and the real-world impact of its ambitious promises. As the spotlight intensifies, the balance between groundbreaking innovation and the need for tangible proof becomes a central theme in evaluating Divergent’s path forward.

Funding and Strategic Alliances

Financial Milestone and Investor Backing

Divergent Technologies’ latest Series E funding round represents a significant milestone, bringing in $290 million, with $250 million in equity and $40 million in debt, led by Rochefort Asset Management. This investment, which elevates the company’s valuation to $2.3 billion, is underpinned by Rochefort’s involvement in the Small Business Investment Company Critical Technology (SBICCT) initiative—a program aligned with U.S. Department of Defense (DoD) priorities to bolster critical technology sectors. The initiative targets small businesses innovating in areas like hypersonics, with the potential to channel up to $4 billion into numerous firms. Divergent’s inclusion in this framework, alongside its cumulative funding of $816 million, signals robust investor confidence. Yet, the alignment of a company with such a high valuation against the initiative’s typical criteria for smaller enterprises raises intriguing questions about how financial eligibility is determined in this context.

Beyond the numbers, the backing from Rochefort Asset Management, a joint venture between Hayman Capital Management and Serengeti Asset Management, highlights a strategic focus on defense manufacturing. This funding is not merely a cash infusion but a vote of confidence in Divergent’s potential to strengthen America’s industrial base. The involvement of a DoD-supported initiative underscores the national security implications of the company’s work, particularly in advancing technologies deemed vital for future defense capabilities. However, the disparity between the reported revenue growth and the valuation prompts a deeper look into whether the financial metrics fully justify the market’s enthusiasm. As Divergent secures this substantial capital, the pressure mounts to translate these resources into measurable advancements in manufacturing technology that align with both investor expectations and strategic national interests.

Industry Partnerships and Growth Targets

Divergent Technologies has forged an impressive array of partnerships with industry giants, spanning automotive brands like Aston Martin, Bugatti, and McLaren, to defense and aerospace leaders such as Lockheed Martin, Raytheon, and General Atomics. These collaborations are more than just name-dropping; they reflect a deliberate strategy to embed the company’s solutions within sectors that demand precision and innovation. With plans to produce over 600 unique parts for aerospace and defense applications, Divergent aims to cement its role as a key player in next-generation manufacturing. These partnerships provide not only credibility but also a testing ground for the company’s technologies, offering real-world applications that could validate its ambitious claims. The scale of these alliances suggests a trajectory aimed at redefining production standards across high-performance industries.

Moreover, the focus on producing a significant volume of unique parts indicates an aggressive push toward scalability and diversification in output. This target is particularly noteworthy in the context of aerospace and defense, where customized, lightweight components are critical to performance and efficiency. By aligning with such prominent industry names, Divergent positions itself to tackle complex manufacturing challenges, potentially setting new benchmarks for speed and adaptability. However, the success of these partnerships hinges on the company’s ability to deliver on its technological promises, ensuring that the collaborative efforts yield innovative outcomes rather than just contractual agreements. As these relationships deepen, the industry watches closely to see if Divergent can transform strategic alliances into a competitive edge that reshapes manufacturing norms.

Technology and Innovation Claims

Unveiling the Divergent Adaptive Production System (DAPS)

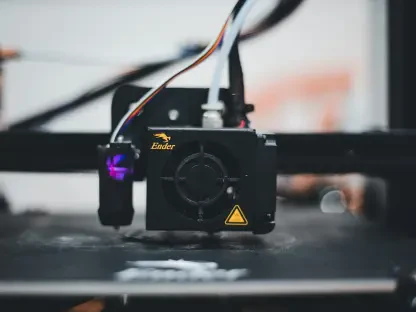

At the core of Divergent Technologies’ vision lies the Divergent Adaptive Production System (DAPS), a software-driven platform designed to revolutionize manufacturing processes across multiple industries. DAPS is touted as a game-changer, capable of sending customized instructions to 3D printers to create specific alloy nodes at industrial rates, followed by a universal robotic assembly process that eliminates the need for design-specific tools. According to company leadership, this system offers unparalleled flexibility and scalability, making it ideal for applications in aerospace, defense, and automotive sectors. The promise is a manufacturing paradigm shift—streamlining production, reducing costs, and enabling rapid adaptation to design changes. If successful, DAPS could redefine how complex components are produced, positioning Divergent as a leader in adaptive, software-defined manufacturing solutions.

The potential impact of DAPS extends beyond mere efficiency; it represents a strategic asset for industries requiring bespoke solutions under tight timelines. By integrating advanced software with hardware, the platform aims to create a seamless production ecosystem that can respond dynamically to varying demands. This adaptability is particularly valuable in sectors like defense, where rapid prototyping and production of specialized parts can be a matter of national importance. Investor enthusiasm, as evidenced by the latest funding round, appears to hinge on this vision of a stronger, more responsive industrial base. Yet, while the conceptual framework of DAPS sparks intrigue, the lack of granular detail about its operational mechanics leaves room for speculation about how much of this vision is already a reality versus a future aspiration.

Questions on Technological Uniqueness

Despite the bold claims surrounding DAPS, a significant cloud of skepticism hangs over the specifics of what sets this technology apart from existing solutions in the additive manufacturing space. Competitors utilize similar 3D printing equipment, such as machines from SLM Solutions, and employ robotic systems for assembly, raising the question of Divergent’s unique value proposition. Is there a proprietary “secret sauce” in DAPS that delivers superior results, whether through process integration, cost savings, or quality control? Public descriptions remain frustratingly vague, with terms like “industrial rates” and “software-defined” assembly failing to clarify the innovation’s edge. This opacity challenges the narrative of groundbreaking advancement, prompting a closer examination of whether the system’s benefits are as revolutionary as portrayed.

Furthermore, the absence of concrete evidence or case studies demonstrating DAPS’ advantages fuels doubts about the justification for Divergent’s high valuation and substantial funding. While the concept of a flexible manufacturing platform is compelling, without clear metrics or comparisons to industry standards, stakeholders are left to wonder if the technology truly outpaces alternatives or if it relies heavily on marketing prowess. The speculation extends to potential areas of value creation, such as real-time tracking of part geometries or integrated quality assurance, but these remain unconfirmed by the company. As scrutiny intensifies, Divergent faces the critical task of bridging the gap between visionary promises and verifiable outcomes, ensuring that its technological narrative withstands the test of industry expectations.

Critical Perspectives and Challenges

Financial and Eligibility Concerns

Divergent Technologies’ financial standing presents a complex puzzle when juxtaposed with its reported metrics and funding eligibility. A fivefold revenue increase signals robust growth, yet the $2.3 billion valuation seems disproportionate when considering the criteria for the SBICCT initiative, which typically supports smaller businesses with net income and book value far below Divergent’s apparent scale. The program’s guidelines suggest limits that appear misaligned with a company of this valuation, prompting questions about how such classifications are applied. While a company spokesperson indicated that eligibility thresholds might vary based on industry standards, the lack of transparency around exact revenue figures adds to the uncertainty, leaving observers to speculate on the financial underpinnings of this high-profile investment.

Additionally, the tension between rapid revenue growth and the massive valuation underscores broader concerns about sustainability and market perception. Investors seem to be banking on future potential rather than current operational scale, a common trend in tech-heavy sectors but one that carries inherent risks. If the revenue base remains modest compared to the valuation, the pressure to deliver exponential returns intensifies. This financial ambiguity also casts a shadow over Divergent’s fit within government-backed programs designed for emerging enterprises, raising the stakes for the company to clarify its standing. As the industry dissects these numbers, the focus shifts to whether Divergent can align its financial narrative with the expectations set by such significant capital inflows and strategic endorsements.

Transparency and Accountability Issues

Transparency, or the notable lack thereof, emerges as a recurring critique of Divergent Technologies’ approach to public disclosure about its core innovations. Descriptions of DAPS often lean on buzzwords and broad claims, such as producing at “industrial rates” or leveraging fully software-defined processes, without offering substantive details to back them up. This vagueness frustrates industry analysts seeking to understand the real technological advancements behind the hype. The lighthearted but pointed question of whether significant government funding supports something as simplistic as a basic robotic setup reflects a deeper concern: are investors and public initiatives backing a genuine breakthrough, or merely a well-crafted story?

Moreover, the accountability tied to DoD-backed funding through the SBICCT initiative amplifies these transparency concerns. Given the strategic national importance of the technologies Divergent claims to advance, the allocation of public-private resources demands clear evidence of impact and innovation. The involvement of such initiatives suggests trust in the company’s potential to bolster critical industrial capabilities, yet without detailed public insights into DAPS’ mechanics or measurable outcomes, doubts persist about the alignment of investment with results. As Divergent navigates this landscape, addressing these transparency gaps will be pivotal to maintaining credibility among stakeholders and ensuring that public trust and capital are placed in demonstrably transformative solutions.

Industry Trends and Broader Implications

Additive Manufacturing Investment Boom

Divergent Technologies’ $290 million funding round fits squarely within a broader surge of investment into additive manufacturing and digital production technologies, a sector increasingly seen as pivotal to industrial evolution. Across aerospace, defense, and automotive industries, the demand for lightweight, complex, and customized components drives capital toward companies promising to disrupt traditional manufacturing. Divergent’s total funding of over $800 million mirrors this trend, reflecting investor optimism about AM’s potential to deliver efficiency and innovation. Government-backed programs like the SBICCT further fuel this momentum, emphasizing public-private partnerships to strengthen domestic capabilities amid global competition. This wave of investment signals a collective belief in technology as a cornerstone of future industrial strength.

However, with substantial capital comes heightened scrutiny, and Divergent’s journey exemplifies the delicate balance between promise and proof in this booming sector. The additive manufacturing industry often grapples with distinguishing genuine technological leaps from speculative hype, as high valuations can sometimes outpace operational realities. While partnerships with major corporations lend Divergent credibility, the broader trend reveals a pattern of skepticism toward firms that fail to provide clear evidence of their innovations’ impact. As funds continue to pour into AM, the challenge for companies like Divergent lies in translating financial backing into concrete advancements that redefine production standards, ensuring that the industry’s enthusiasm is matched by sustainable, verifiable progress.

Shaping the Future of Industrial Innovation

Looking back, Divergent Technologies’ achievement in securing $290 million marked a defining moment in its mission to transform manufacturing through advanced systems like DAPS. The company’s valuation at $2.3 billion and alliances with industry leaders underscored a strong foundation of trust and ambition. Yet, the persistent ambiguity around its technological specifics and financial alignment with funding criteria cast shadows over the narrative. Moving forward, a critical next step for Divergent involves unveiling detailed insights into how its platform outperforms existing solutions, thereby solidifying investor and industry confidence. Establishing transparent benchmarks for success, especially in the context of DoD-supported initiatives, will be essential to validate the strategic importance of its work. As the additive manufacturing sector evolves, Divergent’s ability to turn substantial capital into proven innovation could set a precedent for how emerging tech firms navigate the intersection of promise, scrutiny, and national interest.