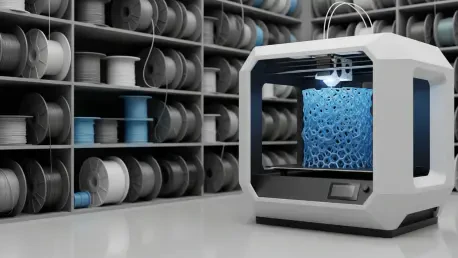

The once-niche world of desktop 3D printing has quietly staged a professional takeover, fundamentally reshaping the manufacturing landscape and setting the stage for a multi-billion dollar market expansion. A new, comprehensive market analysis reveals that the global polymer extrusion 3D printing sector, valued at an estimated $2.2 billion in 2025, is on a robust growth trajectory. Projections indicate that the market will nearly triple in value, soaring to an impressive $6.1 billion by the year 2034. This explosive growth is not being driven by incremental improvements in traditional industrial machines but rather by the relentless proliferation and increasing sophistication of low-cost systems. These accessible yet powerful machines, paired with a burgeoning materials segment, are migrating from hobbyist workshops to the factory floor, democratizing access to advanced manufacturing capabilities and fueling a new wave of innovation across countless industries. The data points to an irreversible trend where affordability and performance are no longer mutually exclusive.

The Dominance of Affordable Hardware

The most profound trend reshaping the polymer extrusion market is the undeniable shift toward the dominance of low-cost systems, which have evolved far beyond their initial prosumer applications to become a cornerstone of modern professional and industrial workflows. This transformation is not a recent development but a sustained movement that has been gaining momentum for years. Compelling data reveals that as early as 2016, the deployment of affordable desktop-style printers in business settings had already outpaced that of their traditional, high-priced professional counterparts. This gap has widened significantly over time. By 2020, the business-related activity on low-cost printers was approximately double that of professional-grade machines. The most recent estimates for 2025 paint an even starker picture, concluding that the low-cost polymer extrusion segment is now nearly three times larger than the entire professional market combined. This evidence confirms that these accessible systems are no longer a peripheral novelty but are deeply integrated into real-world manufacturing environments, serving a wide array of critical applications from prototyping to end-part production.

The rise of accessible hardware has fundamentally altered the competitive ecosystem, creating a new dynamic between emerging market leaders and established industrial giants. Companies such as Bambu Lab, Creality, and Prusa Research, once associated primarily with the consumer and maker communities, are now major players in the professional space, challenging the long-held positions of professional-tier brands like Ultimaker and Raise3D. Their success is built on a model of rapid innovation, community-driven feedback, and aggressive pricing, which has made advanced additive manufacturing capabilities accessible to a much broader audience, including small and medium-sized enterprises. This democratization of technology stands in contrast to the traditional model of high-capital-expenditure systems offered by industrial titans such as Stratasys and 3D Systems. The result is a more fragmented yet vibrant marketplace where businesses have more choices than ever, allowing them to tailor their technology investments to specific needs and budgets, thereby accelerating the adoption of 3D printing across the board.

Materials and Machine Reliability Fueling Expansion

A primary catalyst for this remarkable market expansion, particularly within the low-cost extrusion segment, has been the explosive growth in materials consumption for commercial applications. The success of affordable hardware is not just measured in unit sales but in the tangible output these machines produce. The demand for polymer filaments and other specialized materials for non-consumer, business-oriented projects has surged, registering a compound annual growth rate (CAGR) of more than 23% between the years 2020 and 2025. This powerful statistic indicates that businesses are not only purchasing these systems but are also operating them at high volumes to create functional prototypes, manufacturing aids, and even end-use parts. This consistent and growing demand for materials signals a mature market where the technology is being leveraged as a serious production tool, generating a steady and lucrative revenue stream that supports further innovation in both material science and hardware development. The interplay between accessible machines and advanced materials has created a self-reinforcing cycle of growth and adoption.

Alongside the boom in materials, a critical factor contributing to the integration of low-cost systems into professional environments has been the marked improvement in their operational reliability and overall performance. Continuous enhancements in hardware durability, software usability, and print quality—innovations initially driven by the need to satisfy a demanding, high-volume consumer market—have translated directly into greater viability for industrial use cases. As these machines have become more dependable and user-friendly, the barrier to entry for businesses has lowered significantly. Companies are now deploying these systems with greater confidence and frequency, leveraging them as effective and consistent tools within their production and prototyping workflows. This increase in the utilization rate of the hardware is a testament to its evolution from a hobbyist gadget to a legitimate manufacturing asset, capable of delivering repeatable results with minimal operator intervention, thereby maximizing return on investment.

Strategic Applications in the Defense Sector

The strategic importance of polymer and composite extrusion 3D printing is becoming increasingly evident through its growing adoption within the defense sector, where the technology is being applied to produce a range of critical assets. This high-stakes field is leveraging extrusion-based additive manufacturing for the rapid development and production of unmanned aerial vehicles (drones), essential components for solid rocket motors, various forms of munitions, and other sophisticated defense systems. The appeal of polymer extrusion in this context is driven by its unique ability to meet stringent military requirements. Key advantages include significant cost-efficiencies compared to traditional manufacturing, unparalleled speed of deployment in time-sensitive situations, and the flexibility to produce customized or on-demand parts directly in theater or in challenging operational environments. This capability not only enhances logistical chains but also provides a tactical advantage, allowing for rapid innovation and adaptation to emerging threats on the battlefield.

The comprehensive industry analysis extends beyond hardware to cover the intricate competitive landscape, evolving intellectual property considerations, and detailed market segment forecasts, providing a holistic view of the ecosystem. The research references a vast and diverse array of companies that constitute the industry, from the agile and disruptive low-cost leaders to established professional-tier players and dominant industrial giants, including Thermwood and Caracol. This broad inclusion of market participants underscores the report’s in-depth coverage and its understanding of the complex interplay between different segments of the industry. The credibility of the forecast is substantially bolstered by its rigorous methodology, which is founded upon over twelve years of meticulously collected historical market data. This robust foundation positions the analysis as a vital long-term strategic resource for industrial companies seeking to navigate the evolving landscape, investors looking to identify emerging opportunities, and entrepreneurs aiming to innovate within this dynamic sector.

A Redefined Manufacturing Paradigm

The analysis of the polymer extrusion market ultimately chronicled a fundamental and irreversible shift in the manufacturing world. The confluence of increasingly sophisticated low-cost hardware, innovations in material science, and strategic adoption in critical sectors like defense had reshaped the industry’s landscape. The report’s findings established a clear trajectory where decentralized, accessible production became a core component of modern industrial strategy. It underscored a future where the line between “consumer” and “professional” technology was permanently blurred, a development that created unprecedented opportunities for investors, entrepreneurs, and established companies that recognized this paradigm shift. The data demonstrated that the industry had moved past a point of speculation and into an era of tangible, widespread implementation, solidifying polymer extrusion’s role as a key pillar of 21st-century manufacturing.