In a dynamic convergence of robotics and trade, the Robotics Summit recently brought to light both the technological advancements in robotics and the looming challenges posed by geopolitical shifts. Kwame Zaire, an expert in manufacturing, production management, and a thought leader on predictive maintenance, offers his insights into the nuances surrounding the industry’s present landscape.

What was the main focus of the Robotics Summit, and how did it differ from the informal discussions that took place there?

The official agenda of the Robotics Summit primarily centered around exploring the advancements in autonomous machines and robotics technology. However, behind the scenes, the informal discussions were preoccupied with the ramifications of global tariffs, especially those affecting supply chains and production costs. This distinction illustrated a dual narrative—one of innovation and another of strategic adaptation to economic policies.

How are global tariffs, particularly those related to China, impacting the robotics industry in the U.S.?

Global tariffs have created significant uncertainty that permeates all facets of the robotics industry. They affect the cost and availability of essential components like semiconductors and batteries. This uncertainty is causing American companies to reevaluate their sourcing strategies, often resulting in longer lead times and increased production costs, which can stifle innovation and delay new technologies from entering the market.

Why are semiconductors, batteries, and rare earth magnets particularly affected by global trade disputes?

These components are vital for developing sophisticated robotics and are largely sourced from regions affected by tariffs. Their supply chain intricacies and the specialized nature of their production make them susceptible to disruptions. Global trade disputes exacerbate these vulnerabilities by imposing additional costs and logistical challenges that complicate the manufacturing processes for many tech industries.

How have tariffs affected Tesla’s development of its Optimus humanoid robots?

Tariffs are creating direct barriers in the procurement of materials like rare earth magnets, which are crucial to Tesla’s humanoid robotics projects. This situation forces companies like Tesla to delay timelines and reshuffle priorities. The indirect effects include reallocating resources to navigate the complexities introduced by these economic measures, potentially stalling other innovation avenues.

How are U.S. companies, particularly in the robotics sector, adjusting their supply chains in response to geopolitical shifts?

Companies are increasingly focusing on domestic sources for materials and components to mitigate risks posed by tariffs. This shift can involve restructuring entire production lines and rethinking logistical frameworks. Adapting to these geopolitical dynamics often requires significant investment in domestic capabilities, which can further strain resources but might lead to more resilient supply chains in the long run.

Can you explain the potential opportunities that arise from these geopolitical shifts, as mentioned by Pras Velagapudi?

While challenging, these geopolitical shifts encourage innovation by driving companies to seek out new partners and develop domestic capabilities. This can stimulate the emergence of local industries and create opportunities for companies to diversify their product lines. By incentivizing firms to innovate in problem-solving and efficiency tactics, there lies a potential competitive edge in establishing more self-reliant production ecosystems.

How might tariffs encourage onshoring production, and what impact could this have on labor and automation?

Tariffs can make onshoring a more attractive option by leveling the cost disparities between domestic and foreign manufacturing. This trend could spur greater investment in automation to offset higher labor costs, leading to a shift where robotics and AI play a more central role in the production processes. However, this also means a potential impact on job markets, necessitating retraining programs to adapt the workforce to increasingly automated facilities.

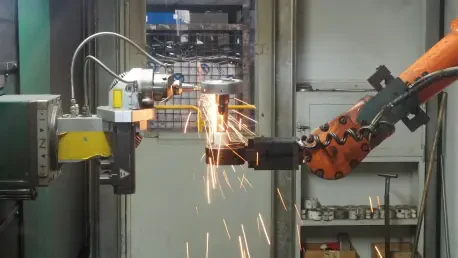

What role do humanoid robots play in the automation process within U.S. factories?

Humanoid robots represent a frontier in automation by offering the potential to perform tasks that are adaptable and complex, tasks which traditional robots might not efficiently handle. Their integration into U.S. factories suggests a transformative step towards more versatile and efficient production lines, where robots could potentially assume roles that require a higher degree of sophistication in problem-solving and adaptability.

How has the installation rate of robots in U.S. automaker plants changed recently?

Recently, U.S. automaker plants have seen a significant uptick in robot installations, underscoring a transition towards automation-driven manufacturing. This growth is driven by the need for increased efficiency and precision in production processes, often fueled by rising labor costs and the pursuit of a competitive edge in a global market.

What are some of the current uses and limitations of humanoid robots, as seen at the conference?

Currently, humanoid robots serve niche markets, primarily in academic research and novelty applications. Their limitations are highlighted by current technological constraints in automation tasks like accurate manipulation and advanced cognitive functions. Nonetheless, their presence at the conference underscored their potential role in diverse applications once technological hurdles are cleared.

How are tariffs affecting the cost and sales strategy for companies like Unitree selling humanoid robots in the U.S.?

Tariffs significantly inflate the costs of these robots, forcing companies like Unitree to raise prices, which can reduce competitiveness. This necessitates a strategic pivot in sales strategies, focusing perhaps on long-term partnerships and expanding into markets less affected by tariffs. The challenge lies in maintaining innovation while navigating these economic hurdles.

What are the prospective markets for humanoid robots outside of academic research and social media influencing?

Beyond academic and social media realms, potential markets for humanoid robots include manufacturing, logistics, and even home assistance. As technological advancements reduce costs and improve functionalities, humanoid robots could become more integral in environments requiring a blend of automation and adaptability, thus broadening their appeal and utility in everyday scenarios.

How has the robotics company Tennibot been impacted by tariffs and global trade issues?

Tennibot, like many others in the sector, faces increased uncertainty and complexity in its supply chain due to tariffs. The reliance on global parts makes the entire production cycle vulnerable to disruptions, compelling the company to reconsider its sourcing strategies. This situation requires a nimble approach to maintain operational continuity and cost-effectiveness.

What concerns are being raised by Canadian robotics and engineering candidates regarding working in the U.S., and how does the current political climate influence their decisions?

Candidates from Canada express hesitancy about moving to the U.S., influenced by political tensions that create an uncertain job market and immigration policies. This apprehension highlights a broader challenge in maintaining a diverse and innovative workforce in the U.S., as political climate considerations become increasingly salient in career decisions and mobility.

Do you have any advice for our readers?

Adaptability is crucial. In rapidly evolving fields like robotics, the ability to pivot in response to global challenges cannot be underestimated. Embracing innovation, remaining aware of geopolitical shifts, and understanding their implications can prepare industries to turn potential disruptions into opportunities for growth and transformation.