In an era where artificial intelligence is reshaping industries and redefining technological possibilities, the semiconductor equipment sector finds itself at the heart of an unprecedented boom, driven by an insatiable demand for advanced chips. From powering complex large language models to enabling autonomous systems, AI applications require immense computational power that hinges on cutting-edge hardware. This hardware, in turn, depends on sophisticated manufacturing equipment capable of producing chips with extraordinary precision and efficiency. The surge in this market is not merely a passing phase but a transformative shift, positioning semiconductor equipment manufacturers as the unsung heroes of the AI revolution. As businesses, governments, and tech giants race to harness AI’s potential, the ripple effects of this demand are felt across global supply chains, economies, and even geopolitical landscapes. This article delves into the forces propelling this rally, exploring the technological innovations, key industry players, and broader implications of a sector that has become the backbone of modern innovation.

Unleashing the AI-Driven Demand Wave

The semiconductor equipment industry is riding a powerful wave of growth, fueled primarily by the escalating need for advanced chips tailored to meet the rigorous demands of artificial intelligence workloads. High-Bandwidth Memory (HBM) and high-performance Graphics Processing Units (GPUs) are essential for AI systems, enabling everything from real-time data processing to complex neural network training. These components require manufacturing processes so intricate that only the most advanced equipment can deliver the necessary precision and scale. Industry analysts describe this phenomenon as an “AI-driven supercycle,” a long-term trend that promises sustained expansion rather than a fleeting uptick. As AI continues to permeate sectors like healthcare, finance, and transportation, the pressure on chipmakers to produce ever-more-powerful hardware intensifies, directly translating into booming demand for the tools that make such production possible.

Beyond the core need for computational power, the diversity of AI applications further amplifies this trend, creating a broad and dynamic market for semiconductor equipment. Generative AI, edge computing, and autonomous technologies each present unique challenges that demand specialized chips, pushing manufacturers to innovate continuously. For instance, edge AI requires low-power, high-efficiency chips for devices operating outside traditional data centers, while generative models need massive parallel processing capabilities. This variety ensures that demand is not concentrated in a single niche but spans a wide array of use cases, compelling equipment makers to adapt and expand their offerings. The result is a robust growth trajectory for the sector, as it becomes a critical enabler of AI’s widespread adoption across industries and applications.

Pioneering Technological Breakthroughs

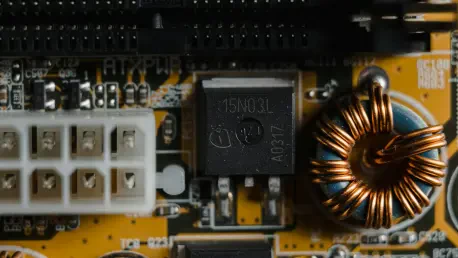

At the core of the semiconductor equipment boom lies a series of groundbreaking technological advancements that have redefined what is possible in chip manufacturing. Leading the charge is ASML, a company with a near-monopoly on Extreme Ultraviolet (EUV) lithography, a technology that allows the creation of chips at incredibly small nodes, sometimes as tiny as 3 nanometers. By packing billions of transistors into tiny spaces, EUV lithography enables the production of chips with unparalleled computational power, a necessity for AI accelerators that drive modern machine learning models. This leap forward marks a significant departure from older manufacturing methods, which struggled to achieve the same level of density and efficiency, thus opening new frontiers for AI hardware development.

Complementing ASML’s innovations are contributions from other industry giants like KLA Corporation, Applied Materials, and Lam Research, each playing a vital role in the manufacturing ecosystem. KLA Corporation specializes in process control and inspection systems that ensure the quality and yield of these highly complex chips, minimizing defects in production. Meanwhile, Applied Materials and Lam Research provide critical deposition and etching equipment, addressing the intricate material and scaling challenges inherent in modern chip architectures. Together, these advancements create a robust framework that meets the exacting standards of AI hardware, pushing the boundaries of performance and efficiency. As a result, the technological prowess of these companies not only fuels the current rally but also sets the stage for future innovations in semiconductor design.

Ripples Through the Tech Ecosystem

The surge in semiconductor equipment is not confined to manufacturers alone but sends powerful ripples across the entire AI ecosystem, benefiting a wide range of stakeholders. Major chip developers such as NVIDIA, AMD, and Intel rely heavily on cutting-edge machinery to produce next-generation hardware that powers AI applications. Without access to the latest equipment, these companies would struggle to meet the performance benchmarks required by today’s AI workloads, from deep learning to real-time analytics. This dependency highlights how the health of the equipment sector directly influences the pace of innovation in chip design, creating a symbiotic relationship that drives progress across both fields.

Additionally, the impact extends to hyperscale cloud providers like Microsoft, Google, and Amazon, which depend on a steady supply of advanced chips to bolster their AI infrastructure and services. These tech giants utilize powerful data centers to support AI-driven solutions, and the availability of high-performance hardware enhances their competitive edge in offering scalable, efficient services. Even smaller players, including startups in the AI space, reap indirect benefits as a more robust supply chain democratizes access to cutting-edge technology. This interconnected web of dependencies underscores the semiconductor equipment sector’s role as a pivotal indicator of the AI industry’s overall vitality, illustrating how advancements in manufacturing amplify innovation at every level of the technological hierarchy.

Navigating Economic and Geopolitical Currents

Economically, the rally in semiconductor equipment translates into significant investments in research and development, job creation, and the fortification of global supply chains. The influx of capital into this sector stimulates growth not only for equipment manufacturers but also for ancillary industries, from raw material suppliers to logistics providers. This economic momentum fosters innovation, as companies allocate substantial resources to develop next-generation technologies that keep pace with AI’s evolving demands. However, this growth also exposes vulnerabilities, as the concentration of manufacturing capabilities in certain regions creates dependencies that could disrupt the flow of critical components during crises or shortages, prompting a reevaluation of supply chain strategies worldwide.

Geopolitically, the strategic importance of semiconductor equipment has elevated it to a matter of national security, influencing policies and international relations. Initiatives like the U.S. CHIPS and Science Act exemplify efforts to bolster domestic manufacturing capabilities, reducing reliance on foreign supply chains amid rising global tensions. While such measures aim to enhance resilience, they also risk escalating trade disputes and fragmenting the global market. Furthermore, the environmental impact of increased manufacturing raises concerns, as the energy-intensive processes and waste generation associated with chip production come under scrutiny. As nations and companies navigate these complex dynamics, the semiconductor equipment sector emerges as a linchpin in shaping economic policies and geopolitical strategies, reflecting its newfound prominence on the world stage.

Charting the Path Forward

Reflecting on the remarkable surge in the semiconductor equipment sector, it becomes evident that this period marks a defining chapter in the evolution of artificial intelligence. The extraordinary demand for advanced chips has propelled companies like ASML, KLA Corporation, Applied Materials, and Lam Research into the spotlight, showcasing their indispensable role in crafting the hardware that powers AI breakthroughs. This rally has not only highlighted the synergy between cutting-edge equipment and AI progress but also revealed the intricate interplay of economic investments and geopolitical maneuvers that shape the industry’s trajectory. The achievements of this era have set a high benchmark, demonstrating how technological innovation can drive transformative change across multiple domains.

Looking ahead, industry observers are encouraged to keep a close eye on capital expenditure trends, strategic partnerships between AI developers and equipment manufacturers, and evolving policy frameworks surrounding semiconductor production. The ongoing vitality of this sector will remain a crucial gauge of AI’s global potential, influencing how quickly and effectively intelligent systems integrate into everyday life. Future considerations should focus on addressing challenges like escalating research costs and environmental sustainability, while fostering international collaboration to mitigate geopolitical risks. As the foundation of AI’s next leaps forward, the semiconductor equipment industry holds the key to unlocking a future defined by smarter, more capable technologies.