A Strategic Infusion to Power Critical Industries

On January 13, 2026, Fremont-based Velo3D announced a $30 million capital raise, signaling strong investor confidence in its 3D printing technology. This funding will accelerate expansion within the space and defense sectors, where demand for complex, mission-critical components is growing. This analysis explores the financing, its strategic implications, and the broader manufacturing trends making this move so pivotal.

The Evolving Landscape of Additive Manufacturing

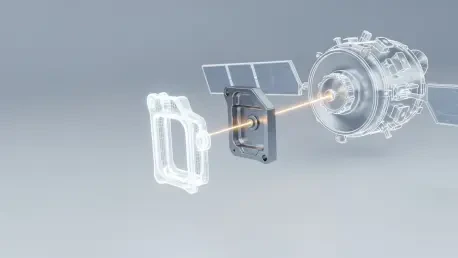

Additive manufacturing has evolved from prototyping to producing high-performance metal parts. Velo3D’s laser powder bed fusion technology meets aerospace’s stringent requirements as geopolitical tensions spur a national push to onshore manufacturing. The company’s ability to create complex parts without internal supports makes it an attractive partner for innovators, now backed by significant investment to scale its impact.

Decoding the Investment and Its Strategic Focus

A Closer Look at the $30M PIPE Transaction

The funding was secured through a private investment in public equity (PIPE) transaction, anchored by a $20 million investment from a new institutional investor, with an existing shareholder contributing the rest. The deal involved issuing approximately 3.6 million shares at $8.25 per share. Backing from both new and current investors underscores deep belief in Velo3D’s vision. Lake Street Capital Markets and Lucid Capital Markets acted as placement agents.

Fueling a New Frontier in Space and Defense Manufacturing

Net proceeds are earmarked for capital expenditures to meet surging demand in the space and defense sectors. Velo3D’s technology enables lighter, stronger components for rocket engines and advanced defense systems. Company leadership views the investment as a strong endorsement, providing capital to scale and address the need for faster, more resilient supply chains in these critical national industries.

The Pivotal Role of Rapid Production Services (RPS)

A key expansion area is the Rapid Production Services (RPS) business. This initiative lowers the high barrier to entry for advanced manufacturing by allowing clients to leverage Velo3D’s technology on-demand. Customers in space and defense can produce and qualify parts without major capital investment, embedding Velo3D’s systems directly into their supply chains and fostering long-term partnerships.

The Future Trajectory: Onshoring and Supply Chain Sovereignty

This investment aligns with the trend toward onshoring and supply chain localization, particularly for national security industries. Velo3D’s technology provides a domestic manufacturing solution that is agile and less dependent on overseas suppliers. The funding will likely empower further R&D, expanding material portfolios and system capabilities to build a more sovereign industrial base.

Key Takeaways for Industry Stakeholders

Velo3D’s fundraising validates production-ready additive manufacturing. For investors, it highlights growth potential in high-barrier-to-entry markets. For aerospace and defense firms, it signals an opportunity to partner with a well-capitalized leader to de-risk supply chains. The clear lesson is that technology must be paired with a flexible business model, like RPS, to drive adoption.

A New Chapter in American Industrial Leadership

This $30 million round is a strategic investment in American manufacturing’s future. By channeling capital into space and defense, Velo3D solidifies its role in the nation’s technological infrastructure. The move underscores a broader industrial evolution toward on-demand, localized production, forging a more resilient and innovative future for the industries that will define the 21st century.