The global metal powder market is on a robust trajectory of substantial growth, with projections indicating an expansion from an estimated USD 7.21 billion to over USD 9.12 billion by 2030, a clear signal of its increasing importance in modern manufacturing. This impressive expansion, which corresponds to a compound annual growth rate of approximately 4.8% between 2025 and 2030, is not a speculative bubble but a direct result of escalating demand from some of the world’s most critical and technologically advanced sectors. Industries such as automotive, aerospace, and healthcare are progressively turning to metal powders to fabricate components that meet stringent requirements for high precision, intricate geometries, and significant weight reduction. This reliance is fundamentally transforming supply chains and production methodologies, positioning metal powders as a cornerstone material for next-generation engineering and innovation, thereby fueling a cycle of sustained development and investment across the globe.

The Dual Engines of Market Growth

A primary finding reveals a dual-engine growth model that underpins the market’s stability and forward momentum, where the industry is simultaneously supported by immense, established demand from traditional manufacturing methods and propelled by the disruptive, high-growth potential of emerging technologies. The transportation sector, a massive category encompassing both automotive and aerospace applications, stands as the undisputed largest end-user of metal powders. This sustained demand is chiefly for the production of lighter and stronger parts, including essential components like gears, bearings, and critical structural elements, all of which are vital for enhancing overall vehicle and aircraft performance. This dominance was quantified in 2024, when the transportation sector accounted for over 65% of all metal powder market sales. This trend is further intensified by contemporary industry-wide shifts, including the global transition toward vehicle electrification and the enforcement of more stringent emissions standards, challenges that necessitate the use of specialized, high-performance powder grades to create lightweight materials that improve fuel efficiency and battery range.

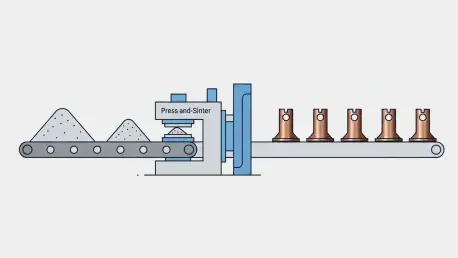

In parallel to the foundational stability provided by conventional sectors, the rapid proliferation of additive manufacturing (AM), more commonly known as 3D printing, is fundamentally reshaping industry demand patterns and creating new avenues for growth. While conventional press-and-sinter manufacturing techniques currently command the market in terms of sheer volume, AM is unequivocally the fastest-growing segment. This transformative technology is revolutionizing both rapid prototyping and the full-scale production of highly customized components, which in turn generates a powerful demand for metal powders with much stricter and more precise specifications for particle size, shape, and purity. This trend is particularly pronounced in the medical and aerospace fields, where additive manufacturing’s unique ability to create incredibly complex geometries with minimal material waste offers a critical competitive advantage. As AM technologies, including sophisticated laser and electron-beam systems, continue to become more accessible and cost-effective, the demand for high-quality, specialized metal powders is expected to experience a significant and sustained surge.

A Detailed Look at Market Segmentation

A more granular analysis of the market reveals distinct segments, each contributing to the industry’s overall health and direction. By material type, iron-based powders constituted the largest segment by consumption in 2024, a status achieved due to their widespread and cost-effective application in automotive components. Other key materials include bronze, aluminum, and nickel powders, which serve critical functions in applications where factors like low weight, high strength, and superior corrosion resistance are paramount. The fastest-growing segment, however, is comprised of titanium and other specialty alloys. These advanced materials are indispensable for high-performance applications in the aerospace and medical device industries, where exceptional strength-to-weight ratios and outstanding material durability are non-negotiable requirements. On the production side, atomization is the most widely utilized procedure, favored for its capability to produce the fine, spherical particles that are ideally suited for both traditional powder metallurgy and advanced additive manufacturing methods, ensuring consistent quality and performance in finished parts.

Geographically, the Asia-Pacific region currently holds the largest share of the global metal powder market and is also forecasted to grow at the fastest rate through 2030. This robust expansion is firmly underpinned by rapidly expanding manufacturing bases, surging automotive production, and significant government and private sector investments in infrastructure across key economies like China, India, and Japan. North America and Europe remain crucial markets, characterized by their strong focus on innovation and high-performance applications, particularly within the advanced aerospace and medical industries, which are supported by well-established industrial infrastructures and a highly skilled workforce. Meanwhile, emerging markets in Latin America, the Middle East, and Africa are also demonstrating increased industrial activity and investment, pointing to significant future growth opportunities and the potential for market diversification as these regions continue to develop their manufacturing capabilities and integrate into the global supply chain.

Forging a Path in a Competitive Landscape

The global metal powder market’s trajectory was firmly set for consistent and diversified expansion through 2030. This growth was built upon a stable foundation of demand from traditional manufacturing sectors, led decisively by the automotive industry, and was simultaneously energized by the rapid adoption of additive manufacturing for specialized, high-value components. While the transportation industry was slated to continue its role as the dominant end-user, the dynamic growth observed in medical applications offered new and exciting avenues for innovation and market specialization. The competitive landscape was shaped by the strategic actions of key players such as Sandvik AB, Rio Tinto Metal Powders, Höganäs AB, GKN Powder Metallurgy, and CRS Holdings, LLC. Ultimately, the market’s future pointed toward sustained, global demand across a broadening array of sectors, a trend that solidified the role of metal powders as a critical industrial material for the foreseeable future.