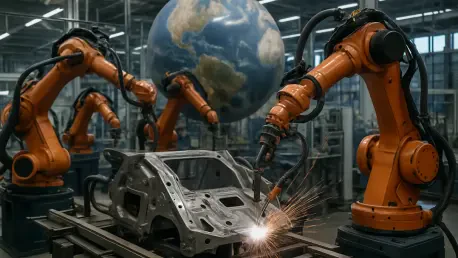

Deep within the industrial heartland of Chongqing, a sprawling factory floor operates in near-total darkness, its silence broken only by the hum and whir of machinery as a new car rolls off the assembly line every sixty seconds. This is the Chang’An Automobile “dark factory,” a marvel of modern automation where over 2,000 robots work tirelessly, slashing production costs by a staggering 20 percent. This single facility is a potent symbol of a much larger transformation, a decade-long strategic campaign that is not only revolutionizing China’s domestic industry but is also poised to fundamentally re-engineer global manufacturing supply chains and recalibrate the balance of international power. The rapid rise of China’s robotics sector is built upon three interconnected trends: an insatiable domestic demand for automation, a burgeoning supply of locally manufactured robots, and an ambitious national pursuit of next-generation innovation. The culmination of these forces presents a complex new reality with profound geopolitical consequences, including a dramatic boost to China’s manufacturing competitiveness, a growing global reliance on its robotics technology, a potential roadblock for the economic development of emerging nations, and a formidable challenge to the manufacturing revitalization efforts of the United States.

The Three Foundational Pillars of China’s Robotics Ecosystem

China’s swift ascent in the robotics industry is not a monolithic phenomenon but a multifaceted development built upon the distinct yet synergistic pillars of demand, supply, and innovation. While each of these core dimensions is progressing at a unique pace, their collective momentum is propelling the nation toward a position of undisputed leadership in the field. This comprehensive ecosystem, nurtured by both state policy and market forces, is creating a self-reinforcing cycle of growth that is rapidly accelerating China’s technological and industrial capabilities, setting the stage for its global influence in the era of advanced automation.

The Demand Side An Unprecedented Surge in Robotics Adoption

The primary engine powering China’s robotics revolution is the immense and rapidly expanding domestic demand for automation, particularly within its colossal manufacturing sector. The sheer scale of this adoption is without parallel anywhere else in the world. In 2024 alone, Chinese factories installed a remarkable 295,000 new industrial robots, a figure that surpasses the combined total of installations across every other nation. This aggressive push has catapulted China’s robot density to 470 robots per 10,000 factory workers as of 2023, placing it firmly among the global elite, second only to the highly automated economies of South Korea and Singapore. The financial scope is equally impressive; the overall Chinese robotics market was valued at an estimated $47 billion in 2024 and is on a trajectory to maintain a robust annual growth rate of 23 percent through 2028, underscoring the sustained and deep-seated nature of this industrial transformation. This demand is not merely a statistical anomaly but a strategic imperative, driven by rising labor costs, an aging workforce, and a national ambition to dominate higher-value manufacturing.

Traditionally, this voracious appetite for robotics has been concentrated in industries characterized by repetitive tasks, predictable production environments, and the need for high precision and vast economies of scale. Consequently, the automotive and electronics manufacturing sectors have historically been the largest consumers of automation technology. In 2024, the electronics industry led the way by installing 83,000 new robotic units, while the automotive sector, a long-time leader in automation, added nearly 55,000. However, a more telling indicator of the future lies in the sectors where growth is now fastest. The food and beverage industry, for example, witnessed an astonishing 86 percent year-over-year increase in robotics adoption in 2024, and the textiles industry grew by a significant 29 percent. This rapid diffusion into less traditional sectors signals that technological advancements and falling costs are making automation economically viable for a much broader spectrum of industries. Furthermore, China’s massive e-commerce sector has become a crucial proving ground for sophisticated autonomous mobile robots (AMRs) used in warehouse logistics, further expanding the scope of robotics applications and creating new data streams to fuel AI development.

The Supply Side The Rise of a Domestic Robotics Manufacturing Powerhouse

A critical and deliberate component of China’s national strategy has been the cultivation of a robust and self-sufficient domestic robotics manufacturing industry. A mere decade ago, the country was heavily dependent on foreign suppliers, importing nearly three-quarters of its robots from industrial powerhouses in Japan and Europe. Today, that dynamic has been dramatically inverted. Domestically produced robots now account for 57 percent of the industrial robots deployed within the country, a testament to the explosive growth of local manufacturing capabilities. This industrial maturation is reflected in the sector’s financial performance; in 2024, China’s domestic output of industrial robots generated an estimated $33.4 billion in revenue, a figure that surged by an additional 28 percent in 2025. This transition from a net importer to a dominant producer is a cornerstone of the nation’s technological sovereignty ambitions and a key factor in its ability to shape global markets.

The domestic market landscape is diverse, featuring established industry champions like Estun and Siasun, which have steadily grown their market share and technological prowess. However, they are increasingly being joined by a new, more agile wave of innovative ventures such as Unitree, Agibot, and UBTech. These newer companies are not just replicating existing technologies; they are aggressively pursuing emerging market opportunities with advanced AI-powered software, novel form factors like humanoid robots, and more cost-effective products designed to democratize automation for small and medium-sized enterprises. This vibrant internal competition is a key driver of innovation and price reduction. The degree of China’s self-reliance varies significantly across different industries. In legacy sectors like automotive manufacturing, where foreign giants have long-established relationships and technological dominance, domestic firms still supply only 31 percent of robots. In sharp contrast, in emerging application areas, Chinese companies face far less entrenched competition. Domestic producers supply 80 percent of the robots used in the food and beverage industry and a reported 100 percent in the textiles and apparel sector. This trend suggests that Chinese firms are not just competing in established markets but are actively outpacing global rivals in creating and capturing new ones, potentially securing powerful and lasting first-mover advantages.

The Innovation Frontier Pursuing Next-Generation Autonomous Systems

The third dimension of China’s comprehensive robotics strategy is a determined and well-funded push to innovate at the absolute technological frontier. While progress in this area is inherently harder to quantify than market share or production numbers, the ambition is clearly reflected in metrics like patent filings and research and development (R&D) expenditures. As of August 2024, Chinese entities reportedly held approximately two-thirds of the world’s effective patents in the field of robotics, a staggering total exceeding 190,000. This intellectual property portfolio provides a powerful foundation for future commercialization and sets the stage for China to become a global standard-setter in robotics technologies, rather than a follower of standards set by others. This focus on foundational innovation is a clear signal that the country aims not just to manufacture robots, but to define what robots of the future will be capable of.

Humanoid robots have emerged as a particularly high-profile symbol of this innovative drive, capturing both public imagination and significant investment. Backed by a potent combination of venture capital and top-level political attention, Chinese firms are working diligently to create versatile, general-purpose robots that could, in theory, perform any physical task currently done by humans. While the authors of the original analysis caution that true, human-level autonomy is still years away and the commercial viability of the bipedal humanoid form factor is not yet guaranteed, the relentless pursuit of this goal is driving crucial advancements in the complex field of “embodied intelligence.” This concept, which involves the seamless integration of perception, locomotion, and reasoning within a physical AI system, is at the heart of next-generation robotics. The technical breakthroughs achieved in areas like spatial reasoning, dynamic balancing, and complex task sequencing are highly transferable to other robot types, such as quadrupeds and advanced wheeled robots, which many of the same companies are developing in parallel. This intense domestic competition, a “trench warfare” environment among thousands of robotics startups, is forcing rapid iteration and will ultimately forge commercially savvy and technologically advanced global competitors.

The Dual Engines of Growth Policy and Commercial Drivers

China’s meteoric progress in the field of robotics is not an accident of market forces but the deliberate outcome of a powerful synergy between comprehensive state policy and potent commercial advantages derived from its unique economic ecosystem. This dual-engine approach has created a fertile ground for the industry’s growth, combining top-down strategic direction and financial support with bottom-up market dynamism and supply chain efficiencies. The result is a self-perpetuating cycle where government initiatives de-risk investment and foster innovation, while commercial realities provide the scale and practical application needed to turn research into globally competitive products.

Comprehensive Policy Support

Since 2014, Beijing has unequivocally identified robotics as a strategic national priority, with President Xi Jinping personally calling for its accelerated development as essential for the nation’s future industrial strength. This top-level political commitment has been systematically translated into a suite of comprehensive and interconnected industrial policies designed to nurture the sector from every angle. Foundational initiatives like the “Made in China 2025” plan, the “Five-Year Plan for Robotics Industry Development,” and the more recent 2023 “Robot+” Application Action Plan have provided a clear roadmap and a stable policy environment for long-term investment. Crucially, these ambitious plans have been backed by massive and sustained financial support from the state. The government has strategically funneled capital into both the production and consumption sides of the robotics ecosystem to stimulate a virtuous cycle of growth and adoption.

To bolster manufacturing capabilities, the state has allocated billions of dollars in direct grants, low-interest loans, and generous tax credits to domestic robotics manufacturers. A particularly striking example of this support is a government guidance fund announced in March 2025, which aims to channel an immense $137 billion into promising AI and robotics startups over the next two decades. Much of this funding is decentralized, disbursed by proactive provincial and municipal governments, with major tech hubs like Beijing, Guangzhou, and Shenzhen each launching their own multi-billion-dollar funds to cultivate local champions. State support also extends to crucial pre-competitive R&D through a network of national labs and research institutes under the Chinese Academy of Sciences (CAS) and the Ministry of Industry and Information Technology (MIIT). Simultaneously, to cultivate a robust domestic market, municipal governments offer generous subsidies to companies that purchase locally manufactured robots. Guangzhou, for instance, subsidizes 20 percent of the purchase cost, directly incentivizing local factories to “buy Chinese.” Furthermore, state-owned enterprises (SOEs) are often directed to procure robots from domestic champions, providing these emerging firms with crucial early revenue, large-scale deployment opportunities, and a powerful signal of government confidence that helps attract private investment.

Potent Commercial Drivers

While deliberate policy has been a crucial catalyst, the original analysis argues that powerful commercial factors rooted in China’s long-standing manufacturing dominance are perhaps an even more significant engine of its robotics boom. Chinese robotics firms benefit from unparalleled and immediate access to the world’s most complete and efficient supply chains for essential components like high-performance motors, advanced sensors, and powerful batteries. This deep integration and geographic proximity allow them to source high-quality components more quickly and cheaply than their international counterparts. One compelling estimate suggests that the total material cost to build a standard robotic arm in China is less than half of the equivalent cost in the United States, granting Chinese manufacturers a formidable and structural cost advantage from the outset.

This inherent advantage is magnified by the massive economies of scale that China’s vast domestic market and extensive global trade links provide. For Chinese manufacturers, the business case for replacing ongoing, rising labor costs with a one-time capital investment in robotics is exceptionally strong, a trend that is being further amplified by the country’s demographic shifts toward an aging population. Moreover, China’s technology giants, renowned for their vertically integrated business models, are investing heavily in the robotics sector. Companies like Huawei, Xiaomi, BYD, and Alibaba are developing sophisticated in-house robotics programs that leverage powerful synergies with their existing operations in artificial intelligence, advanced manufacturing, and global logistics. This model not only accelerates the pace of innovation by integrating R&D with real-world application but also guarantees an initial, large-scale market for their robotic products. Finally, China’s strong position in AI research provides a rich talent pool and a solid technological foundation for developing the advanced embodied intelligence that will define the next generation of autonomous systems. Crucially, the massive scale of robot deployment across China gives its companies a decisive and widening advantage in collecting the vast amounts of real-world training data necessary to continuously improve robot performance and reliability.

Global Geopolitical Impacts and Strategic Challenges

The culmination of China’s surging demand, expanding domestic supply, and frontier innovation in robotics positions the nation to become the dominant global force in automation. This emerging leadership is not merely an industrial achievement; it confers significant geopolitical leverage and creates a new and complex set of strategic challenges for the rest of the world. As Chinese robots become more capable and affordable, their proliferation will reshape manufacturing economics, alter trade relationships, and force governments from Washington to Nairobi to reassess their industrial policies and long-term development strategies.

Enhanced Domestic Manufacturing Competitiveness

China is strategically leveraging robotics to enhance its existing manufacturing prowess across the entire value chain, from low-cost assembly to high-tech production. In high-value sectors such as automotive manufacturing and green energy technologies—including solar panels and electric vehicle batteries—automation allows Chinese firms to achieve unprecedented economies of scale. This capability enables them to push prices below those of their global competitors, which could exacerbate existing international concerns about industrial overcapacity and unfair trade practices. This directly challenges the viability of established manufacturers in advanced economies in Europe, Japan, and North America, threatening their market share and long-term profitability in critical industries.

Simultaneously, and perhaps more consequentially for the global economic order, automation is allowing China to maintain and even strengthen its competitiveness in traditionally low-value, labor-intensive industries like textiles and apparel. These were sectors where China was widely expected to lose its advantage due to steadily rising domestic labor costs, paving the way for other developing nations to take their place on the ladder of industrialization. However, by substituting capital for labor through robotics, China can defy this traditional economic trajectory. This development poses a profound threat to the established economic development model for emerging economies in Southeast Asia, Africa, and Latin America. For decades, their primary comparative advantage has been a large pool of low-cost labor. In a world where the upfront capital cost for advanced automation becomes the deciding factor in production location, that advantage may become increasingly irrelevant, potentially closing a critical pathway out of poverty for millions of people.

Growing Overseas Reliance on Chinese Robots

Having successfully reduced its own dependence on foreign robotics technology, China is now pivoting to become a major exporter of robots to the rest of the world. The country’s share of global industrial robotics exports has already seen a dramatic increase, growing from just 5.9 percent in 2020 to a significant 16.7 percent in 2024, with Southeast Asia and Europe emerging as its largest and fastest-growing markets. As automation becomes an economic necessity for maintaining manufacturing competitiveness globally, many countries may find themselves with little choice but to rely on affordable, capable, and readily available Chinese robots to upgrade their industrial base. This dependency is unlikely to be limited to just hardware.

This growing reliance could soon extend across the entire technology stack. It is highly probable that Chinese firms will export comprehensive, wrap-around services for AI software, predictive maintenance, and factory logistics alongside their physical robots. This would create vertically integrated ecosystems that are deeply embedded in their customers’ operations and difficult for international competitors to penetrate or displace. Such a scenario could give Beijing significant leverage, not only in commercial negotiations but also in the geopolitical arena. For the United States, this presents a stark dilemma. Washington aims to revitalize its domestic manufacturing base but lacks a robust industrial robotics sector of its own, with a robot density of only 295 per 10,000 workers and a heavy reliance on imports from Japan and Germany. To close this critical automation gap, the U.S. faces a series of difficult choices: import cheaper robots from China, which would raise significant cybersecurity and intellectual property protection concerns; rely on more expensive alternatives from allies like Japan and Europe, who are themselves facing intense competitive pressure from China; or attempt a costly, long-term strategy to build its own domestic robotics industry from a relatively low starting point. The developments in China’s robotics industry had already set in motion a global realignment that demanded immediate and strategic responses from policymakers worldwide.