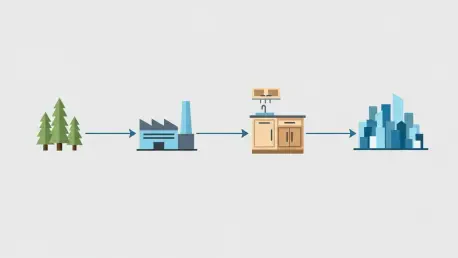

A critical sector of the Canadian economy, the furniture and kitchen cabinet industry, finds itself in a precarious position, grappling with the severe economic fallout from substantial U.S. tariffs that threaten the livelihood of thousands. While a recent decision to halt a planned escalation of these duties offered a brief respite, the existing financial burdens continue to inflict significant damage, pushing many businesses to the brink. This situation is further complicated by a web of international trade disputes, including accusations of tariff circumvention by Chinese firms and the looming, high-stakes review of the Canada-U.S.-Mexico Agreement (CUSMA). As a result, industry leaders are sounding the alarm, warning of widespread job losses and business closures unless the Canadian federal government intervenes decisively to protect a sector that is a cornerstone of communities across the country.

A Temporary Reprieve, An Ongoing Crisis

The crux of the issue lies in the 25 percent tariff imposed by the United States on Canadian furniture, cabinets, and vanities, a measure that has sent shockwaves through the manufacturing landscape. Although the industry collectively breathed a sigh of relief when a proposed increase to a staggering 50 percent for cabinets was paused just before its implementation, this delay is seen as a minor concession in a much larger economic battle. Luke Elias, a prominent voice from the Canadian Kitchen Cabinet Association, has emphasized that the industry is still “reeling” from the initial 25 percent duty. He explained that such a significant financial shock cannot be easily absorbed within the tight margins of a manufacturing environment, immediately impacting operational stability and eroding profitability. This sentiment is echoed across the sector, where the pause is viewed not as a solution but merely as the postponement of a potentially catastrophic scenario that still looms large on the horizon.

The economic scale of this crisis is substantial, placing a vital part of Canada’s manufacturing base at risk. The Canadian kitchen furniture sector alone is a $4.7-billion industry, with approximately $600 million in annual exports flowing directly to the United States, making it a critical source of trade revenue. The tariffs strike at the very heart of this export-reliant business model, creating immense uncertainty for companies that have spent decades building relationships with American clients. This external pressure is dangerously compounded by an already weakening domestic housing market in Canada, which has further suppressed local demand for new kitchen cabinets and furniture. This confluence of negative factors has created a perfect storm, leaving manufacturers squeezed from both sides of the border with diminishing avenues to sustain their operations, forcing them to confront difficult decisions about their future viability in an increasingly hostile trade environment.

The Human Cost and A Broken Supply Chain

The devastating real-world impact of these trade policies is powerfully illustrated through the experience of Elias Woodwork, a Manitoba-based company that provides employment for over 400 people and exports roughly 80 percent of its products to the U.S. market. The company’s president, Ralph Fehr, described the existing 25 percent tariff as damaging and asserted that a 50 percent duty would have been nothing short of “catastrophic.” He logically questioned the sustainability of his business under such conditions, pointing out the challenge of convincing American customers to pay a massive premium for Canadian content. Fehr’s testimony also sheds light on the deep integration of the North American supply chain; his company imports raw materials like hardwood lumber from the Appalachian region of the U.S., processes them into finished goods in Canada, and then sells them back to American consumers. This intricate model, painstakingly built over 45 years with the encouragement of the Canadian government, is now under existential threat, with the tariffs having completely erased the company’s profit margins.

This dire situation is far from an isolated incident, as the financial strain is being felt across the entire industry. Since the tariffs were first implemented, reports of layoffs have become increasingly common, with meetings among industry stakeholders revealing that multiple companies were warning of imminent and significant job losses. The atmosphere is one of profound crisis, with industry representatives describing the situation in stark terms, stating that many businesses are in “dire straits.” This has forced a fundamental shift in business strategy, away from growth and innovation and towards a desperate focus on cost reduction and operational streamlining simply to survive. This defensive posture not only stifles the industry’s potential but also threatens to undo decades of progress, leaving a sector that employs over 25,000 Canadians in a fight for its very existence, with the human cost of these tariffs mounting with each passing day.

International Intrigue and A Tense Future

The justification provided by the Trump administration for these punitive tariffs is rooted in complex international trade dynamics, particularly concerning China. The American Kitchen Cabinet Alliance (AKCA) has been a vocal proponent of the duties, arguing that Canada and Mexico have become conduits for Chinese goods to circumvent existing U.S. tariffs. In 2020, the U.S. Commerce Department imposed significant anti-dumping and countervailing duties on cabinets imported directly from China. Following this action, the AKCA contended that Chinese manufacturers simply rerouted their supply chains through neighboring countries. Luke Meisner, counsel for the AKCA, vividly described this alleged circumvention by stating, “China didn’t leave the U.S. market. It just changed the return address.” This narrative provides the rationale for the administration’s claim that tariffs on Canadian furniture are a necessary measure to “bolster American industry and protect national security,” framing the issue as a defense against unfair global trade practices rather than a direct attack on a key ally.

Interestingly, leaders within the Canadian furniture industry have acknowledged a related challenge that complicates their position. Luke Elias noted that legitimate Canadian manufacturers are also being negatively affected by the importation of low-priced furniture and cabinet parts from Asia. These components are brought into Canada, assembled into finished products, and subsequently exported to the United States under a “made-in-Canada” label. This practice not only undermines domestic producers who use authentic Canadian materials and labor but also lends a degree of credence to the American complaints about circumvention. This internal problem has added another layer of complexity to the trade dispute, highlighting the need for a more nuanced approach from the Canadian government. In response, the industry is pleading for Ottawa to strengthen its “Build Canada” procurement policies and, more critically, to address the issue of parts being imported at below-market value, a problem that harms the domestic market and complicates crucial trade relations with the U.S.

Navigating a Path Forward

The resolution to this multifaceted crisis remained deeply intertwined with the high-stakes review of the Canada-U.S.-Mexico Agreement. The American Kitchen Cabinet Alliance had been actively lobbying to strengthen the agreement’s rules-of-origin requirements, aiming to establish what they termed a “Fortress North America” that would prevent cheap, circumventing products from being dumped in either Canada or Mexico. This push made a quick or easy solution for Canada highly unlikely, as negotiations were expected to be tense, especially with President Trump’s previous threats to withdraw from the trade pact altogether. Hopes for any near-term relief were further diminished when trade talks were abruptly called off, reportedly due to political friction. In the face of this uncertainty, a palpable fear grew within the Canadian furniture and cabinet sector—an industry comprising 3,500 companies—that its plight would be ignored by policymakers in favor of more high-profile sectors like steel and automobiles. As industry leaders lamented, their products were ubiquitous in homes across the continent, yet their struggles remained largely unheard, leaving a vital pillar of the Canadian economy to face an uncertain future.