The fate of a 120-year-old paper mill in the Dordogne region of France now stands as a powerful symbol of a wider industrial reckoning, where the short-term strategies of financial institutions clash with the long-term necessities of manufacturing. As the Condat mill, currently under the ownership of financiers Tikehau and Apollo, is placed on the market, its future hangs in a delicate balance, attracting significant interest from industrial buyers who recognize its intrinsic value within Europe’s vital wood-paper ecosystem. This pivotal moment is not merely a corporate transaction but a critical test case for whether specialized industries can escape the cycle of debt-laden financial engineering and return to stewardship by those with a genuine commitment to the craft. The outcome will determine the survival of hundreds of jobs, the economic stability of a region, and the viability of a more sustainable, industry-led model for legacy manufacturing sectors across the continent.

A Critique of the Prevailing Financial Model

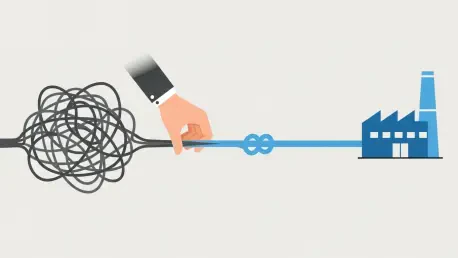

The struggles at Condat are not an isolated incident but rather the culmination of a decades-long experiment in financial ownership that has proven fundamentally unsuited for the specialty paper sector. Since 1998, the mill has been controlled by a succession of financial entities, a model that has led its parent company, Lecta, to a point where its market value is now eclipsed by its accumulated debt. This trend is mirrored across the industry, with comparable companies like Fedrigoni experiencing a dramatic loss of valuation under similar ownership structures. While a previous owner, CVC Capital Partners, is credited with navigating a period that saw many of Condat’s French competitors shutter their gates, this appears to be a rare exception that underscores the inherent unsustainability of the financial model. This approach, driven by quarterly returns and exit strategies, fundamentally lacks the patient capital and deep-seated industrial passion required to innovate and thrive in a complex, capital-intensive manufacturing environment, leaving behind a legacy of underinvestment and strategic stagnation.

The mill’s precarious financial position was further exacerbated by a government-mandated investment that, while well-intentioned, proved to be a strategic misstep. The requirement to spend 50 million euros on a new steam boiler, driven by what critics have termed “blind ecological dogmatism,” diverted critical resources away from the company’s core need: product innovation and modernization of its production lines. This significant capital outlay weakened Condat’s balance sheet without directly enhancing its competitiveness in the global paper market. Concurrently, the Ministry of the Economy has been perceived as adopting a passive stance, allowing events to unfold without decisive intervention. However, the ministry holds significant leverage over Tikehau and Apollo, as these financial firms depend on government goodwill for their other extensive ventures in France. This dynamic presents an opportunity for officials to pressure the current owners into ensuring a viable future for the paper business, transforming a passive observation into an active role in securing the mill’s industrial legacy.

The Path to a Viable Industrial Transition

For any potential industrial buyer to succeed, a comprehensive financial reset is not just desirable but absolutely essential. The weight of Condat’s existing debts, a legacy of its financial ownership, must be lifted to provide a clean slate for a new operator. Any serious contender, such as the interested Chinese stationer Xianhe, would require the current shareholders to write off these liabilities. Beyond the debt, a new owner would need an estimated 15 million euros in immediate working capital to fund a probable and necessary redundancy plan and to effectively manage the significant environmental risks inherent in a manufacturing site that has been in operation for over a century. This prerequisite restructuring is a non-negotiable starting point for any realistic takeover bid, as no industrialist can be expected to inherit the financial burdens created by past speculative strategies and still be positioned to make the long-term investments the mill desperately needs to survive and eventually prosper.

Achieving this necessary financial restructuring will demand decisive action from all stakeholders, particularly those with financial claims against the company. A critical component of this reset involves Kyotherm, the entity that financed the new boiler, which would need to forfeit its 35 million euro claim to facilitate a sale. Similarly, the Nouvelle-Aquitaine Region is being called upon to convert its 5.5 million euro claim into shares, transforming its role from a creditor to a long-term partner in the mill’s future. These concessions are not simply financial maneuvers; they represent a collective commitment to prioritizing the industrial survival of Condat over the recovery of past debts. Forcing the hand of the current “bankrupt” financial shareholders to act responsibly has become the central challenge. The future of the jobs, the social cohesion of the region, and the local environment now depended entirely on this orchestrated transition from a failed financial paradigm to one rooted in dedicated industrial ownership.