In recent years, the landscape of domestic case goods manufacturing in the United States has undergone significant shifts. Despite facing formidable challenges, the industry continues to embrace new opportunities to remain competitive and relevant in the global market. The juxtaposition of speed to market, rising deglobalization trends, and evolving consumer preferences underscores the complexity and dynamism of this sector. This article delves into the multifaceted layers of U.S. domestic furniture manufacturing to uncover both its strengths and its persistent challenges.

The Advantage of Speed to Market

Rapid Turnaround as a Competitive Edge

One of the most significant advantages that U.S. domestic manufacturers hold over their international counterparts is the ability to quickly deliver products to market. Andy Bray, President of Vanguard Furniture, emphasizes that domestic production can ship custom pieces within four weeks—a drastic improvement over the four to six months often required for international shipments. This quick turnaround is particularly beneficial in an industry driven by frequent shifts in consumer tastes and expectations. Domestic manufacturers’ ability to adjust production schedules to meet specific demand spikes gives them a strategic edge.

This rapid fulfillment capability means that retailers can better keep up with the latest trends and consumer demands, thereby reducing the risk of inventory obsolescence. Coupled with faster delivery times, retailers can reduce holding costs and respond more nimbly to market changes. The agility provided by a shorter supply chain means that retailers can stock a wider range of current styles and seasonal products, enhancing consumer satisfaction. Whether it’s catering to specific design trends or responding to unexpected market needs, the speed at which domestic manufacturers can act is unparalleled.

Consumer Implications

The capability for rapid fulfillment means that retailers can better keep up with the latest trends and consumer demands, thereby reducing the risk of inventory obsolescence. In an era where consumers expect fast service, this agility in supply chains provides a tangible advantage. Whether it’s catering to seasonal preferences or responding to a viral trend, the speed at which domestic manufacturers can act is unparalleled.

For consumers, this means access to the latest trends and customizable pieces without the lengthy waiting periods typically associated with international orders. The rapid response to market demands enhances overall customer satisfaction and fosters loyalty as consumers recognize the reliability of domestic production. In a world where instant gratification is increasingly valued, the ability to quickly deliver high-quality, customized furniture becomes a substantial competitive advantage for U.S. manufacturers.

Cost Challenges in Domestic Manufacturing

Labor and Regulatory Costs

Despite the advantages, U.S. manufacturers grapple with higher operational costs, primarily driven by labor and regulatory expenses. These heightened costs often translate into higher prices for the consumer, impacting profit margins and positioning in a competitive market. It’s a delicate balancing act to maintain quality and affordability, making it a crucial challenge for domestic manufacturers.

Labor costs in the United States are notably higher than in many international manufacturing hubs, particularly in Asia. Regulatory compliance further adds to these expenses, encompassing health and safety regulations, environmental standards, and fair labor practices. While these regulations ensure higher workplace standards and product quality, they also drive up costs, compelling manufacturers to seek efficiencies elsewhere to remain competitive.

Impact on Pricing and Profit

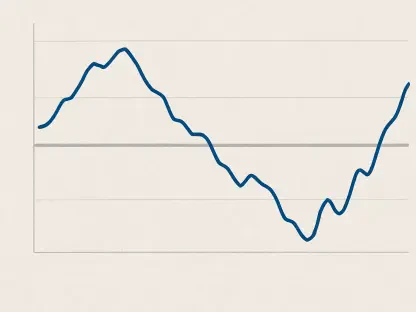

The higher costs associated with domestic production influence both pricing and profit margins significantly. Domestic manufacturers find it challenging to compete on price with international producers who benefit from lower labor costs and more lenient regulatory environments. This economic reality forces U.S. companies to either accept slimmer margins or risk pricing themselves out of the market.

Manufacturers are often caught in a bind between maintaining profitability and offering competitive pricing. The additional business costs impose a financial burden that can limit potential market expansion and profitability. This can lead to innovative cost-saving measures, such as investment in automation and lean manufacturing techniques, to mitigate the impact on profit margins. Nonetheless, achieving the perfect balance remains a perennial challenge for U.S. domestic furniture producers.

Enhancing Supply Chain Reliability

Dependable Domestic Supply Chains

One of the standout strengths of domestic production is supply chain reliability. The COVID-19 pandemic starkly highlighted the vulnerabilities of global supply chains, particularly those heavily dependent on Asian manufacturing. Domestic producers, however, face far fewer supply chain disruptions, offering a more stable supply of goods to retailers. This reliability ensures a more consistent production flow, mitigating the risks associated with international shipping delays, geopolitical tensions, and unexpected global events.

The reduced distance and complexity associated with domestic supply chains enable better monitoring and control over the manufacturing process. This control translates to higher quality assurance, fewer production interruptions, and quicker problem resolution. Consequently, retailers benefit from a more predictable product availability, which in turn supports better planning and inventory management. These advantages make domestic production a more attractive option for retailers looking to avoid uncertainties tied to international logistics.

Strategic Advantage in Inventory Management

Retailers can rely on domestic manufacturers for more predictable and timely inventory management. This reliability is crucial in avoiding stockouts and backlogs, thereby enhancing the overall customer experience. With fewer interruptions and delays, domestic supply chains enable a more consistent flow of products from the warehouse to the consumer.

By maintaining shorter lead times and fewer disruptions, domestic supply chains empower retailers with the ability to swiftly react to sales data and market trends. This adaptability is beneficial for managing seasonal demand swings and maximizing revenue opportunities during peak periods. Retailers are better equipped to meet consumer expectations for faster delivery and in-stock availability, further solidifying their market position and fostering customer loyalty.

Deglobalization Trends

Shifting Manufacturing Paradigms

There’s a noticeable trend towards deglobalization, as noted by Ben Copeland of Copeland Furniture. The traditional model of shipping raw materials to Asia for manufacturing before returning the finished goods to the U.S. is increasingly becoming less viable. Rising global manufacturing costs, coupled with higher duties and tariffs on Chinese products, are prompting a reevaluation of this model. The shift towards bringing more manufacturing back to the U.S. reflects a growing awareness of the inherent vulnerabilities and costs associated with relying heavily on international production.

Deglobalization is reshaping manufacturing paradigms, encouraging companies to rethink their supply chain strategies. Companies are now more focused on building resilient, localized manufacturing ecosystems that minimize geopolitical risks and enhance control over quality and production timelines. This paradigm shift is aligned with broader economic and political moves towards self-sufficiency and sustainability, as companies and governments alike recognize the strategic importance of reducing dependency on foreign production.

Implications for the U.S. Market

The shift towards deglobalization could potentially revitalize U.S. manufacturing. As the economics of global trade evolve, there is a renewed opportunity for domestic producers to expand their capabilities and reclaim a larger share of the market. This movement could foster a more self-sufficient and resilient manufacturing ecosystem within the United States. The economic recalibration presents an opportune moment for U.S. manufacturers to innovate, reinvest, and capture previously offshored production.

By focusing on domestic production, manufacturers are better positioned to respond to market demands for ethical and environmentally sustainable products. Consumers are increasingly conscious of the environmental and social impact of their purchases, and domestic production aligns well with these values by reducing the carbon footprint associated with international shipping. The trend towards deglobalization also creates opportunities for job creation and economic revitalization in regions historically affected by the decline in manufacturing activities.

Evolving Consumer Preferences

Quality Over Price

There’s a growing trend among U.S. consumers towards valuing quality over lower prices. This shift is particularly evident in the high-end market segment. Tom Zaliagiris of Sherrill Furniture points out that consumers are increasingly inclined towards superior craftsmanship and customized pieces, which underscores a significant opportunity for domestic manufacturers to differentiate themselves through quality.

This consumer preference for quality extends beyond durability and aesthetics—it encompasses ethical production practices and sustainable materials. More consumers are willing to pay a premium for products that align with their values, such as those made with eco-friendly processes or fair labor practices. Domestic manufacturers, with their stringent adherence to regulatory standards and easier traceability of production practices, are well-positioned to capitalize on this trend.

Tailored and High-End Products

The preference for high-quality, tailored products offers a promising avenue for U.S. manufacturers, especially those targeting the affluent, quality-conscious consumer base. By focusing on craftsmanship and bespoke offerings, domestic producers can effectively carve out a niche in the premium segment of the market. This shift towards customization allows manufacturers to build brand loyalty through unique and personalized customer experiences.

Consumers are increasingly seeking furniture pieces that not only fit seamlessly into their living spaces but also reflect their personal style and values. This demand for individuality and originality plays into the hands of domestic manufacturers who can offer superior customization options compared to mass-produced imports. By adopting advanced manufacturing technologies, such as 3D printing and CNC machining, domestic producers can enhance their ability to deliver meticulously crafted, tailor-made products.

Investment and Expansion in Domestic Manufacturing

Need for Substantial Capital Inflows

The expansion of domestic manufacturing capabilities necessitates significant investments. Gat Caperton from Gat Creek Furniture highlights the need for substantial capital inflows, similar to those received by China over the past two decades. These investments are essential for upgrading facilities, adopting advanced technologies, and enhancing production efficiencies.

To realize such transformative growth, a coordinated effort is required involving both private sector investment and public policy support. Emerging technologies such as automation, artificial intelligence, and advanced materials handling can dramatically boost productivity and reduce manufacturing costs. However, these technologies require significant upfront capital and a skilled workforce to manage and operate them effectively.

Government and Private Sector Roles

For effective expansion, both private investors and government support are crucial. Initiatives that encourage investment in domestic manufacturing can transform the sector, making it more competitive on a global scale. With the right funding and strategic focus, the U.S. furniture manufacturing industry can achieve greater capacity and resilience.

Public policies aimed at supporting manufacturing can take many forms, including tax incentives, grants for technological innovation, and initiatives to develop a skilled workforce. Collaborative efforts between the government, educational institutions, and industry players are essential to create a robust talent pipeline. Investments in training programs and apprenticeships can equip a new generation of workers with the skills needed for modern manufacturing facilities, ensuring the sustainability of the domestic manufacturing renaissance.

Overcoming Labor Shortages

Educational Programs and Skilled Labor

A persistent challenge for domestic manufacturers is the availability of skilled labor. While community colleges offer furniture manufacturing programs, they are currently insufficient to meet the industry’s demand. Many students entering these programs are already employed and seeking to upskill, rather than entering the industry anew, highlighting the urgent need for expanded educational initiatives.

Collaborative efforts between industry leaders, educational institutions, and governments are critical in addressing this talent gap. Creating attractive career pathways in furniture manufacturing can entice younger generations to consider this field as a viable and rewarding career choice. Marketing campaigns that highlight innovative aspects of modern manufacturing and the potential for good wages and job stability can also help in shifting perceptions about careers in manufacturing.

Automation in Manufacturing

While automation in furniture manufacturing has progressed, it remains limited. Technologies like CNC routers and automatic fabric-cutting machines have partially addressed labor shortages, but many detailed tasks, such as frame tying and case goods finishing, still require manual intervention. Industry leaders like Andy Bray acknowledge that while automation can aid processes, it cannot entirely replace human craftsmanship, especially for higher-end products.

Embracing a hybrid approach that combines automation with skilled craftsmanship could offer the best of both worlds. Automated systems can handle repetitive, labor-intensive tasks, freeing human workers to focus on the more complex, intricate elements of furniture making that require a keen eye and adept hands. This balance can enhance productivity while maintaining the high standards of quality that consumers expect from domestically produced goods.

Conclusion

In recent years, the landscape of domestic furniture manufacturing in the United States has seen substantial changes. Even amid formidable challenges, the industry continues to find new opportunities to stay competitive and relevant within the global market. As consumer preferences evolve, and deglobalization trends rise, the sector faces a complex array of factors impacting its operations and growth. This article explores these multifaceted elements to reveal both the strengths and ongoing challenges faced by the U.S. furniture manufacturing industry.

The industry’s ability to quickly bring products to market has become a crucial advantage. With consumers increasingly demanding fast turnaround times and customized products, manufacturers must adapt to keep up. This need for speed has led to innovations in production processes and supply chain management. At the same time, the deglobalization movement, which emphasizes local production over international supply chains, has opened new doors for domestic manufacturers.

However, these opportunities come with their own set of challenges. Rising production costs, a shrinking skilled labor pool, and the ever-present threat of international competition make it difficult for U.S. manufacturers to maintain their edge. Additionally, the industry must navigate complex regulatory environments and sustain environmentally friendly practices to meet consumer expectations and legal requirements. Despite these obstacles, the sector’s resilience and adaptability continue to highlight its potential for future growth.