A New Era of Onshoring: Lillys Multi-Billion-Dollar Manufacturing Pivot

In a striking departure from decades of industry practice, pharmaceutical giant Eli Lilly is executing a profoundly confident and expensive strategic realignment by committing over $50 billion over the past five years to expand its manufacturing footprint on American soil. This is not merely an investment in new infrastructure; it represents a calculated decision to reshape the foundations of pharmaceutical production for a new global era. This analysis will deconstruct Lilly’s multi-billion-dollar wager, exploring the motivations behind this massive onshoring effort, the advanced technologies driving it, and what it signifies for the future of drug manufacturing in the United States and beyond.

Recalibrating Global Supply Chains: The Post-Pandemic Imperative

For decades, the pharmaceutical industry’s mantra was efficiency through globalization. The production of active pharmaceutical ingredients (APIs)—the core components of medications—was largely offshored to countries like China and India, where lower labor and operational costs promised higher margins. This model, however, exposed a critical vulnerability. The COVID-19 pandemic, coupled with rising geopolitical tensions, laid bare the fragility of these long-distance supply chains. Suddenly, reliance on foreign partners for essential medicines became a matter of national security, while the looming threat of tariffs on imported raw materials presented a significant financial risk. This backdrop is essential for understanding Lilly’s dramatic shift; it is a direct response to a changed world, where supply chain resilience has become as valuable as cost efficiency.

Dissecting the Domestic Investment Strategy

High-Tech Hubs: The Core of U.S. Production Expansion

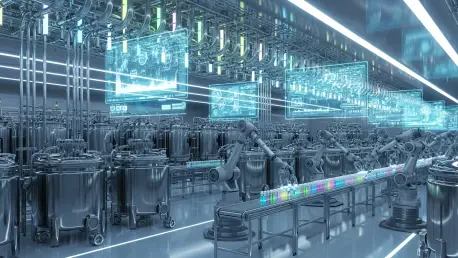

At the heart of Lilly’s strategy are several state-of-the-art facilities designed to be the new backbone of its U.S. operations. A centerpiece is the planned $6 billion API plant in Huntsville, Alabama, a next-generation site for producing small molecule synthetic medicines. This facility is crucial for manufacturing promising new drugs like orforglipron, an oral GLP-1 agonist for obesity that could become a blockbuster. The Huntsville site, chosen for its skilled workforce and proximity to the HudsonAlpha Institute for Biotechnology, will heavily integrate AI, machine learning, and comprehensive digital automation to optimize production. This Alabama plant is just one piece of a larger puzzle, joining a $6.5 billion facility in Houston, Texas, and a $5 billion site near Richmond, Virginia, focused on cancer and autoimmune therapies, bringing total commitments for four new U.S. sites to $27 billion.

Hedging Against Geopolitical Risk and Economic Volatility

Lilly’s massive U.S. investment is fundamentally a de-risking strategy. The pharmaceutical industry is increasingly wary of its exposure to international trade disputes and logistical bottlenecks. As industry analyses note, drugmakers are taking calculated steps to reduce exposure to these risks. The threat of tariffs on imported APIs can instantly inflate production costs and disrupt financial planning. By onshoring the production of critical ingredients, Lilly insulates a significant portion of its supply chain from such volatility. However, industry experts characterized this move not as a complete reshoring, but as a sophisticated hedging strategy. The goal is not to sever all international ties but to build a robust domestic capacity that can act as a buffer, ensuring a stable supply for the critical U.S. market regardless of external shocks.

A Dual-Pronged Approach: Balancing Domestic and Global Footprints

While the $50 billion U.S. figure grabs headlines, it would be a misconception to view Lilly’s strategy as isolationist. The company is simultaneously strengthening its global manufacturing network to ensure flexibility and worldwide reach. It is constructing a $3 billion oral medicine facility in the Netherlands to bolster its European capacity and investing $1 billion in India to expand its contract manufacturing partnerships. This dual approach reveals a more nuanced strategy: fortify the domestic supply chain for resilience while maintaining a diversified global footprint for scale and market access. This ensures Lilly can meet surging demand for its breakthrough therapies, like its GLP-1 drugs, both at home and abroad, without being overly reliant on any single region.

Setting a New Industry Precedent for Pharma 4.0

Eli Lilly’s aggressive onshoring is poised to create a ripple effect across the entire pharmaceutical industry. This move sets a new precedent, challenging competitors to re-evaluate their own supply chain vulnerabilities and consider similar domestic investments. The future of drug manufacturing will likely be characterized by a hybrid model—a blend of highly automated, AI-driven domestic mega-sites for critical products and a network of trusted international partners for others. This shift could lead to greater national health security and more stable drug availability for American patients. Furthermore, the focus on advanced technology in these new plants will accelerate the adoption of “Pharma 4.0,” where data analytics and automation drive efficiency, quality, and innovation from the factory floor.

Ripple Effects Across the Pharmaceutical Ecosystem

The takeaways from Eli Lilly’s strategy are clear and far-reaching. For investors, this massive capital expenditure represents a long-term investment in stability and risk mitigation, potentially safeguarding future revenue streams from geopolitical disruption. For policymakers, it underscores the importance of creating an environment—through tax incentives, workforce development, and streamlined regulations—that encourages domestic manufacturing of essential goods. For other pharmaceutical companies, Lilly’s actions serve as a powerful case study in supply chain resilience, compelling them to assess their own dependencies and consider whether a similar hedging strategy is necessary to remain competitive and secure in an unpredictable world.

The Verdict on a Landmark Bet: Redefining Pharma Resilience

Ultimately, the analysis of Eli Lilly’s $50 billion bet revealed it was far more than an investment in steel and concrete; it represented a forward-looking verdict on the future of global trade and manufacturing. The strategy was identified as a decisive pivot toward resilience, control, and technological supremacy in an industry where supply chain integrity is paramount. By bringing the production of its most innovative medicines home, Lilly not only protected its business but also actively redefined what it means to be a leader in the 21st-century pharmaceutical landscape. This monumental wager on American manufacturing signaled that in today’s volatile world, the safest supply chain was often the one closest to home.